NMTC Financing for Borrowers

Since 2000 federal new markets tax credit financings (“NMTC Financings”) has been provided to approximately 10,800 businesses and nonprofits and have created $8 of private investment for every $1 of NMTC Financing.

As discuss herein, CRA provides NMTC Financing placement services and project management services throughout on a contingent fee basis.

To print out this discussion, please click on the following link: NMTC Financing for Borrowers

Additionally, please click on any Section in the Table of Contents to go to the applicable discussion.

- The Intent and Purpose of the NMTC Program

- Good Borrowers and Projects

- Economics of NMTC Financing

A. Forgivable Loan

B. Forgivable Loan Leverage Structure

C. Other Subsidies Used with NMTC Financing

D. Forgivable Loan Unwind after 7-Year Compliance Period

E. Alternative Loan Products - Legal Requirements

A. Low-Income Community

B. Targeted Population Alternative Test

C. Qualified Active Low-Income Community Business/Nonprofit

D. Qualified Business/Operations

E. Reasonable Expectations Tests

F. Permitted Uses

G. Prohibited Uses - Underwriting Requirements

A. Closing-Ready

B. Substantial Community Impacts

C. Strong Local Support

D. But-For Test - Competitive Advantages

A. Highly Distressed

B. Non-Metropolitan

C. Innovative Investments - Recapture Events

- Financial, Tax and Compliance Reporting

- State NMTC and Similar Programs

- Placement, Closing and Project Management Services

A. Placement and Closing Services

B. Project Management Services

1. The Intent and Purpose of the NMTC Program

In 2000, Congress enacted new Section 45D of the Internal Revenue Code of 1986, as amended (the “Code”) to provide federal new markets tax credits (the “NMTC Program”) to encourage investment in “low-income communities” (“Low-Income Communities”) because they often do not have access to traditional financing. The NMTC Program is administered by the Community Development Financial Institutions Fund (the (the “CDFI Fund”) which is a division of the U.S. Treasury Department).

The NMTC Program is intended to increase various community impacts, as described below.

NMTC Financing can be used for real estate and non-real estate purposes.

2. Good Borrower and Projects

Each of the following are good types of borrowers (whether for-profit or nonprofit) and projects for NMTC Financing because they provide substantial community and economics to their local communities and their residents:

-

- manufacturing facilities/operations;

- healthcare facilities/operations;

- grocery stores and food banks/operations;

- charter and independent schools/operations;

- qualified mixed-use projects (if at least 20% of the gross revenue is from non-residential revenue);

- community facilities/operations; and

- renewable energy and recycling operations/operations.

3. Economics of NMTC Financing

Each year, “qualified community development entities” (“CDEs,” which are either for-profits or nonprofits) apply to the CDFI Fund for non-monetary allocation awards (“Allocation Awards”). If a CDE receives an Allocation Award, it is known as an “Allocatee” and executes an “Allocation Agreement” with the CDFI Fund.

Applicants complete an annual application, which includes detailed questions regarding the applicant’s (a) business strategy (such as financial projects to be offered and targeted types of borrowers and uses of the subsidy); (b) community outcomes (such prior and anticipated job creation, consumer/community goods and services and beneficiaries, minority impacts, and/or environmental impacts); (c) management capacity; and (d) capitalization strategy.

Potential for-profit and nonprofit borrowers apply to Allocatees for a “sub-allocation” (a “Sub-Allocation”) of a portion of their Allocation Awards.

Selection of borrowers and projects must be consistent with an Allocatee’s Allocation Agreement.

If an Allocatee provides a Sub-Allocation to a borrower, then an Allocatee will organize a new special purpose CDE (the “Sub-CDE”) for the particular NMTC Financing.

A financial institution or corporation (a “Tax Credit Purchaser”) effectively and indirectly purchases the federal new market tax credits (the “NMTCs”) and the proceeds of the purchase price (the “NMTC Purchase Price”) are used to provide either (a) a forgivable loan (which is much more common) or (b) another type of loan (which is not forgivable), as discussed below, to a borrower.

Additionally, all legal and accounting fees as well as transaction costs are paid out of the Tax Credit Purchase Price.

The vast majority of CDEs applying for Allocation Awards commit to provide at least 5 of the following nontraditional and favorable terms (“5 Favorable Terms”) to the borrower:

-

- below market interest rates;

- lower than standard origination fees;

- longer than standard period of interest-only payments;

- higher than standard loan to values;

- more flexible borrower credit standards;

- nontraditional forms of collateral or unsecured;

- lower than standard debt service coverage ratios; and

- subordination.

The NMTCs are equal to 39% of the Tax Credit Purchaser’s ultimate “qualified equity investment” (a “QEI,” which is equal to the Sub-Allocation).

For example:

- Assume that (a) an Allocatee receives a $50,000,000 Allocation Award from the CDFI Fund; (b) the Allocatee provides a $10,000,000 Sub-Allocation to a borrower; and (c) a Tax Credit Purchaser indirectly purchases the NMTCs for $0.80 per $1.00 NMTC.

- The NMTCs would be $3,900,000 (i.e., 39% x $10,000,000 Sub-Allocation; however, the Sub-Allocation must be supported by a QEI in the same amount, which is discussed later).

-

- The NMTC Purchase Price would be $3,120,000 (i.e., $3,900,000 NMTCs x $0.80 pricing).

-

- The $3,120,000 NMTC Purchase Price would be used to fund the borrower’s (i) construction of a new facility; (ii) renovation of existing facility; (iii) purchase and/or refurbishment of equipment; and/or (iv) working capital (collectively, the “Project”).

The NMTC Purchase Price is approximately 1/3 of the total Sub-Allocation (i.e., the NMTC Financing).

The NMTC Financing must satisfy various requirements during the 7-year compliance period (the “7-Year Compliance Period”), which is discussed later.

Section 45D(c) of the Code requires, in relevant part, that the subsidy be provided as either “deb” or “equity” to the borrower in order to be a “qualified low-income community investment” (a “QLICI”).

Tax Credit Purchasers, Allocatees and borrowers do not facilitate the NMTC Financing using equity for a variety of reasons beyond the scope of this discussion. Therefore, the subsidy is provided in the form of “debt.”

A. Forgivable Loan

When Congress passed Section 45D of the Code, it did not contemplate (a) how NMTC Financings would be structured due Tax Credit Purchasers’ risk assessment and (b) the time and costs of CDEs applying for Allocation Awards and ongoing costs during the 7-Year Compliance Period. Specifically, as discussed later, the Internal Revenue Service (the “IRS”) issued Treasury Regulations and two revenue rulings that permit the so-called “Leverage Structure”), as discussed below. Additionally, the CDFI Fund often provides guidance with respect to permitted transactions and special rules.

Thus, NMTC Financings must satisfy the requirements of (a) Section 45D of the Code (i.e., Congress’s statute); (b) Treasury Regulations, (c) the Leverage Structure parameters (which is used in the vast majority of NMTC Financings); and (d) CDFI Fund guidance. To satisfy all of these requirements, NMTC Financings involve substantial legal and accounting fees to support several required tax opinions and underwriting requirements. Allocatees fees to cover prior costs in applying for Allocation Awards and ongoing compliance costs.

These transaction costs are generally approximately 50% of the NMTC Purchase Price. However, they are paid out of the NMTC Purchase Price proceeds at closing.

As a result of these substantial fees and costs, the vast majority of NMTC Financings are structured to be forgiven (a “Forgivable QLICI Loan”) at the end of the 7-Year Compliance Period, which is discussed later. Originally, the NMTC Financings were intended to be paid off or refinanced at the end of the 7-Year Compliance Period and merely provide at least 5 Favorable Terms.

At the end of the 7-Year Compliance Period, the forgiveness of the Forgivable QLICI Loan results in cancellation of indebtedness. However, (a) all of the transaction costs are amortizable; (b) whatever the borrower finances (such as real estate, equipment, and working capital) is depreciated or deducted; and (c) presumably the proceeds of the Forgivable QLICI Loan results in increased profitability. Therefore, NMTC Financings are generally tax neutral and subject only to timing issues. For nonprofits, cancellation of indebtedness income is a moot point from a tax perspective.

B. Forgiven Loan Leverage Structure

In 2003 and 20210, the IRS revenue rulings, which provide that a Tax Credit Purchaser does not have to fully fund the QEI on which the NMTCs are based. Specifically, the Tax Credit Purchaser organizes a wholly owned investment fund (the “Investment Fund”) to facilitate the Leverage Structure.

The Tax Credit Purchaser makes a capital contribution in the amount of the NMTC Purchase Price to the Investment Fund. Another party provides a “Leverage Loan” to the Investment Fund. The Leverage Loan requires interest-only payments during the 7-Year Compliance Period. Using the proceeds of the NMTC Purchase Price and the Leverage Loan, the Investment Fund makes the QEI in the CDE.

For example (using the prior example) and as illustrated in the following Link: Leverage Structure.

- The Tax Credit Purchaser makes a $3,120,000 capital contribution (i.e., the NMTC Purchase Price) in the Investment Fund.

- The Leverage Lender makes a $6,880,000 Leverage Loan to the Investment Fund.

- Using the proceeds of $3,120,000 capital contribution and $6,880,000 Leverage Loan, the Investment Fund makes a $10,000,000 QEI in the Sub-CDE.

- As a result, the Investment Fund is entitled to the $3,900,000 NMTCs (i.e., 39% x $10,000,000 QEI is the same amount as the Sub-Allocation, as previously discussed).

- The Investment Fund allocates the $3,900,000 NMTCs to the Tax Credit Purchaser.

- This permits the Tax Credit Purchaser to effectively purchase the $3,900,000 NMTCs without having to provide the $10,000,000 QEI (i.e., it has leveraged its QEI with the Leverage Loan) in the Sub-CDE in exchange for a 99.99% limited member interest in the Sub-CDE (and the Allocatee retains a 0.01% managing member interest in the Sub-CDE).

Typical sources of the Leverage Loan include an affiliate of the Tax Credit Purchaser or Allocatee; traditional loans; donations; grants; bonds; and/or owner funds.

It is important to note that the provider of these sources of funds often cannot have a direct security interest in the borrower’s assets and the sole collateral is the Tax Credit Purchase’s ownership interest in its Investment Fund. However, often there are structuring alternatives that can otherwise provide direct collateral or amortization during the 7-Year Compliance Period.

For example, if the intended project is the construction of a new facility, the providers of what otherwise would be the Leverage Lender(s) provide financing (the “Source Financing”) directly to borrower (or affiliate thereof) as the Leverage Lender affiliate. The Leverage Lender affiliate would use such provides to make the Leverage Loan to the Investment Fund. The NMTC Financing would be provided to the borrower (or an affiliate) (whichever is not the Leverage Lender) and it would then lease or ground lease the new facility from the Leverage Lender. The related lease payments (as well as interest on the Leverage Loan) would then be used by the Leverage Lender to pay debt service on the Source Financing. Thus, the providers of the Source Financing will receive a direct mortgage and collateral assignment of the ground lease or lease.

In 2015, the CDFI Fund provided a special rule that permits borrowers to effectively use up to 24 months of their prior expenditures to unrelated parties provided that they are directly attributable to the borrower’s operations and are similar in size and scope to similarly situated borrowers.

Thus, in lieu of a Leverage Loan (or portion thereof), a borrower can effectively and economically use its prior incurred costs for the NMTC Financing.

A discussion of this special rule is beyond the scope of this discussion; however, such rule effectively provides a credit for a source of leverage in lieu of actual funds being required to be provided by the borrower.

The Leverage Loan proceeds generally flow through the Leverage Structure and are lent by the Sub-CDE to the borrower in the form of a “Senior QLICI Loan.”

The Senior QLICI Loan only requires interest payments during the 7-Year Compliance Period at a rate that is the weighted average of any interest rates provided by the sources of the Leverage Loan. Interest payment on the Senior QLICI Loan is paid to the Sub-CDE and then through the Leverage Structure to pay interest on the Leverage Loan.

C. Other Subsidies Used with NMTC Financing

NMTC Financing can be used in connection with state NMTCs, historic tax credit financing, and other community and economic development programs (such as taxable bonds, some tax-exempt bonds, opportunity zone financing, and those provided by the USDA Programs and the CDFI Programs).

However, NMTC Financing cannot finance any square feet to the extent that low-income housing tax credits finance such square feet.

CRA works with clients to structure NMTC Financings to include these subsidies, some of which can be used as a source for the Leverage Loan.

D. Forgivable Loan Unwind after 7-Year Compliance Period

As previously discussed, each of the Senior QLICI Loan and the Forgivable QLICI Loan must be treated as “debt” for federal income tax purposes. This requires a multi-factor analysis. An intent to forgive is a significant factor to support that the Forgivable QLICI Loan is not “debt” but rather “equity” (which the Tax Credit Purchaser and Allocatee do not want) or a “grant” (which is not permitted by Section 45D of the Code).

In order to address this factor, the industry uses an unwind structure. This is facilitated pursuant to an “option agreement” or a “put and call agreement.”

At the end of the 7-Year Compliance Period, (a) the Tax Credit Purchaser has the option to “put” (i.e., sell) its 100% ownership interest in the Investment Fund (which owns 99.99% of the Sub-CDE) for a nominal amount (such as $1,000 plus exit taxes and legal fees) to one of the borrower’s affiliates (which usually acts as the Leverage Lender or otherwise exists or is created for this purpose) and (b) the Allocatee has the right to redeem its 0.01% managing member interest in the Sub-CDE for a nominal amount (such as $100).

The Senior QLICI Loan is generally assigned to the Leverage Lender and then paid off or amortized as required by the sources of funds used for the Leverage Loan.

A typical unwind transaction is illustrated in the following Link: Unwind After 7-Year Compliance Period.

How do borrowers get comfortable that the Tax Credit Purchaser will “put” its 100% limited interest in its Investment Fund?

The Tax Credit Purchaser:

-

- generally, receives a 9% to 12% internal rate of return on the NMTCs;

- receives credit under the Community Reinvestment Act (which encourages certain insured depository institutions to help meet the credit needs of the communities in which they are chartered, including low- and moderate-income neighborhoods, consistent with the safe and sound operation of such institutions);

- receives significant goodwill by providing funds that are used to assist local business and nonprofits that provide substantial community impacts; and

- would be “black-balled” or “cancelled” in the NMTC marketplace because it nullified the intended benefit of the NMTC Financing in the form of the Forgivable Loan.

- generally, receives a 9% to 12% internal rate of return on the NMTCs;

How do borrowers get comfortable that an Allocatee will redeem its .01% managing member interest in the Sub-CDE?

The Allocatee:

- receives its upfront Sub-Allocation Fee of the Tax Credit Purchase Price;

- receives ongoing asset management, monitoring, and overhead reimbursement out of the Tax Credit Purchase Price; and

- has furthered its mission of serving, or providing investment capital, to Low-Income Communities resulting in significant community impacts.

A few Allocatees (approximately 15%) require a percentage of the Forgivable QLICI Loan to be paid back or the discretion to do so if community impacts are not achieved (generally up to 25%), which they then redeploy to another borrower in an economically distressed community. However, it is important to note that any such requirement is stated in the term sheet and then in the NMTC Financing documents.

CRA identifies, profiles and solicits Allocatees and Tax Credit Purchasers for optimal nontraditional and favorable terms and flexible underwriting requirements based on our clients’ needs, nature of their operations, uses of the subsidy, and types of community impacts that will result.

CRA maintains profiles of all Tax Credit Purchasers and Allocatees, which we (a) update each year based on the Allocatees’ commitments in their Allocation Agreements commitments and (b) periodically update for specific demand for particular types of borrowers and projects at any point in time.

CRA is a gateway of creditability when we represent our clients to Tax Credit Purchasers and Allocatees.

Please see Section 10 hereof for a description of our Placement and Closing Services.

E. Alternative Loan Products

There are alternative NMTC products encourage by the CDFI Fund. These include (a) QLICI loans that are either (a) $4 million or less or (b) have a term of 60 months or less (each an “Innovative QLIC Loan”).

Each of the products include at least 5 Favorable Terms but are not forgiven.

4. Legal Requirements

There are many statutory and regulatory requirements as well as specific guidance provided by the IRS and the CDFI Fund (which administers the NMTC Program).

Generally, to the extent that a Borrower and/or project does not satisfy any of the legal requirements, the NMTC Financing can generally be structured to address all of the legal issues without adversely affecting the economic benefits of the NMTC Financing

It is critical that these issues be addressed from the outset in order to avoid complications as the NMTC Financing proceeds to closing.

As discussed in more detail below, in order to obtain the Forgiven Loan, there are several legal requirements including, but not limited to, the following:

-

the Project or operations, as applicable, must be “predominantly” located in a “Low-Income Census Tract” or otherwise benefit “Targeted Populations;”

the Project or operations, as applicable, must be “predominantly” located in a “Low-Income Census Tract” or otherwise benefit “Targeted Populations;”

- there must be a gap in available financing (the so-called “But For Test” must be satisfied);

- the Borrower (which can be a for-profit or a nonprofit) must be a “Qualified Active Low-Income Community Business;

- the Borrower’s trade or business (or the nonprofit’s purpose and operations) must be a “Qualified Business;” and

- the Borrower must satisfy the “For-Profit Reasonable Expectations Test” or the “Nonprofit Reasonable Expectations Test,” as applicable, during the 7-Year Compliance Period.

A. Low-Income Community

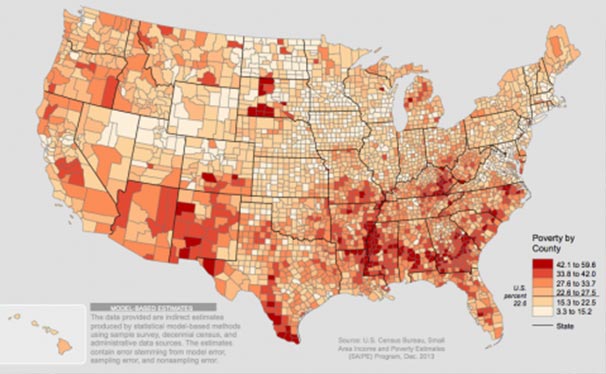

The Borrower or the project, as applicable, must be “predominantly” located in “Low-Income Community,” which is defined by U.S. Census data as a census tract with:

-

- a poverty rate of at least 20%, or

- either:

- in the case of a tract located in a metropolitan area, the median family income (“MFI”) for such tract does not exceed 80% of the greater of (x) the statewide MFI or (y) the metropolitan area MFI, or

- in the case of a tract not located in a metropolitan area, the MFI for such tract does not exceed 80% of the statewide MFI

- the NMTC Financing proceeds must be used for “Permitted Uses” and not for “Prohibited Uses;” and

- there cannot be a “Recapture Event.”

The requirement to be predominantly located in a Low-Income Census Tract only has to be satisfied on the date of the funding of the NMTC Financing. If the census tract subsequently is disqualified as a Low-Income Community, such fact does not matter as long as the Borrower or project, as applicable, remains in such census tract (or otherwise relocates to another Low-Income Community during the 7-Year Compliance Period).

B. Targeted Populations Alternative Test

Alternatively, if a Borrower or a project is not predominantly located in a “Low-Income Community,” it can be deemed to be in a “Low-Income Community” if it otherwise benefits “Low-Income Persons” (as “Targeted Populations”) throughout the 7-Year Compliance Period (the “Targeted Populations Alternative Test”).

Therefore, if the Targeted Populations Alternative Test is used, Allocatees and Tax Credit Purchaser generally require that higher percentage(s) be used as an underwriting matter in order to reduce the risk of a “Recapture Event.”

Given this ongoing requirement, the vast majority of Tax Credit Purchasers and Allocatees will not participate in a NMTC Financing that relies on the Targeted Populations Alternative Test.

C. Qualified Active Low-Income Community Business/Nonprofit

The Borrower must be a “qualified active low-income community business” (a “QALICB”), which is a corporation, partnership, limited liability company or tax-exempt entity, and has a trade or business (or, in the case of a nonprofit, any activity that furthers its charitable purpose), which is a “Qualified Business.”

Additionally, it must satisfy each of the 5 requirements during the term of the NMTC Financing.

-

at least 50% of its total gross income must be derived from the active conduct of a “Qualified Business” within one or more “low-income communities” (the “Gross Income Test”);

at least 50% of its total gross income must be derived from the active conduct of a “Qualified Business” within one or more “low-income communities” (the “Gross Income Test”);- at least 40% of the use of its tangible property (whether owned or leased) must be within one or more LICs (the “Tangible Property Test”); and

- at least 40% of the services performed by its employees must be performed within one or more LICs (the “Services Performed Test”).

Alternatively, the Gross Income Test is also satisfied if 50% instead of 40% is used in either of the Tangible Property Test or Services Performed Test.

If the Borrower does not have employees, the Services Performed Test is satisfied if 85% instead of 40% is used in the Tangible Property Test.

These 3 requirements are not required if the Targeted Populations Alternative Test is being used.

During the term of the NMTC Financing, the Borrower must also have:

- less than 5% of the average aggregate unadjusted bases of its property can only be attributable to “Collectibles” (such as antiques) other than collectibles that are held primarily for sale to customers in the ordinary course of business; and

- less than 5% of the average of the aggregate unadjusted bases of its property can only be attributable to “Nonqualified Financial Property” (such as holding cash or cash equivalents, or owning debt, stock, and partnership interests; however, reasonable working capital and construction reserves are permitted above this threshold).

Working capital and construction reserves are considered to be “reasonable” if they are reasonably expected to be expended within 12 months of the funding of the NMTC Financing.

If construction is anticipated to be longer than 12 months, there are ways in which to structure the financing to address this issue.

Note: If any of the percentage requirements discussed in paragraphs (d) through (j) are not satisfied, they can easily be satisfied y creating a so-called “portion of business,” which maintains separate books and records similar to a division. These books and records are used solely for the NMTC Financing and does not affect how the Borrower otherwise provides financial and tax reporting.

D. Qualified Business/Nonprofit

A “Qualified Business” includes any business that is not specifically exempted as described below.

A Qualified Business can include manufacturing, healthcare, grocery, education, qualified mixed-use, nonprofit, and renewable energy/recycling etc. and:

-

- if the Borrower is a for-profit business, it must be reasonably expected to generate revenues (as opposed to net income) within 3 years of the funding of the NMTC Financing

- less than 5% of the average of the aggregate unadjusted bases of its property can only be attributable to “Nonqualified Financial Property” (such as holding cash or cash equivalents, or owning debt, stock, and partnership interests; however, reasonable working capital and construction reserves are permitted above this threshold).

- if the Borrower is a for-profit business, it must be reasonably expected to generate revenues (as opposed to net income) within 3 years of the funding of the NMTC Financing

However, a Qualified Business does not include:

-

“Residential Rental Housing Property” (unless part of a qualified mixed-use project, as previously discussed);

“Residential Rental Housing Property” (unless part of a qualified mixed-use project, as previously discussed);- farming;

- a business that consists “predominantly” (i.e., more than 50%) of the development and holding of intangibles for the purpose of sale or licensing; or

- any of the following so-called “Excluded Businesses:” (a) a private or commercial golf course; (b) a country club; (c) a gambling facility; (d) a racetrack; (e) a hot tub facility; (f) a suntan facility; (g) a massage parlor; or (h) any store the principal purpose of which is the sale of alcoholic beverages for consumption off premises.

These prohibited businesses are similar to those prohibited by the federal tax-exempt bond rules. They also do not provide the types of community and economic impacts that satisfy the intent of the NMTC Program.

Additionally, if a Borrower leases a NMTC financed project, no tenant may be an Excluded Business (although the other types of businesses listed above may be tenants) (a “Tenant Qualified Business”). However, there are ways to structure the NMTC Financing to satisfy this prohibition.

As discussed above, NMTC Financing cannot be used for Residential Rental housing” unless such housing is part of a mixed-use project which generates at least 20% of its gross revenue from non-residential sources (such as retail and commercial etc.). Additionally, for underwriting purposes, the Tax Credit Purchaser and Allocatee require this percentage to be higher. However, there are ways to structure the NMTC Financing to satisfy this requirement, such as carving out any excess portion of the Project so that this percentage requirement can be satisfied.

An annual NMTC Compliance Certification is required. Typical certifications can be found at the following Line:

E. Reasonable Expectations Tests

If the Borrower is a for-profit business, it must be reasonably expected to generate revenues (as opposed to net income) within 3 years of the funding of the NMTC Financing (the “For-Profit Reasonable Expectations Test”).

If the Borrower is a nonprofit organization, it must be reasonably expected to engage in an activity that furthers one or more of its charitable purposes within 3 years of the funding of the NMTC Financing (the “Nonprofit Reasonable Expectations Test”).

For Profit Reasonable Expectations Test, it is important to note that if such revenues are not generated within 3 years, that does not violate the For-Profit Reasonable Expectations Test, it is important to note that if such revenues are not generated within 3 years, that does not result in the failure of the For-Profit Reasonable Expectations Test because the test is that it must be “reasonably expected” to do so on the date of the funding of the NMTC Financing based on reasonable assumptions.

The satisfaction of the For-Profit Reasonable Expectations Test must be illustrated in financial projections, which must support that all of the debt service payments of the NMTC Financing will be timely paid based on reasonable assumptions.

With respect to a Nonprofit Reasonable Expectations Test, it is important to note that if such engagement in an activity that furthers one or more of its charitable purposes does not occur within 3 years, that also does not result in the failure of the Nonprofit Reasonable Expectations Test because the test is that it must be “reasonably expected” to do so on the date of the funding of the NMTC Financing based on reasonable assumptions.

The Nonprofit Reasonable Expectations Test does not require an expectation that revenues be provided (as there is for for-profit Borrowers), and the nonprofit can operate at a projected and actual loss over the term of the NMTC Financing as long as it can show that its debt service payments will be timely paid in financial projections based on reasonable assumptions. Again, we provide such financial projections.

F. Permitted Uses

NMTC Financing may only be used by a “Qualified Business” to:

-

- acquire, construct, renovate and expand bricks and mortar projects (including those relating to healthcare, education, manufacturing, retail, qualified mixed-use, cultural, community, and renewable energy etc.); and

- finance business and nonprofit operations (such as those in the nature, as described above), including the purchasing, refurbishing, retrofitting, or leasing of equipment, and/or funding working capital, inventory, and staffing etc.

However, there are ways to structure the NMTC Financing to address any uses that initially do not qualify.

G. Prohibited Uses

NMTC Financing may not be used to:

-

- generally, refinance or prepay existing debt;

- participate in any abusive transaction; or

- finance any activity that is not part of a Qualified Business.

Sometimes, Allocatees will permit a portion of the Forgivable Loan to pay off some debt provided that the borrower can show that the debt service payments are overly burdensome.

However, it is important to note that the proceeds of the NMTC Financing may result in the borrower otherwise being able to save its own funds to apply to these uses if proper structuring is in place.

5. Underwriting Requirements

The most significant underwriting requirements are:

-

- being “Shovel Ready;”

- providing or retaining substantial community impacts to residents in “Low-Income Communities” and “Targeted Populations” (such as “Low-Income Persons,” minorities, women and veterans); and

- having strong local support.

A. Closing-Ready

To be “Closing Ready,” Borrower must show that:

- all other sources of financing are otherwise committed (or close to being committed);

- all other conditions are satisfied (or close to being satisfied), such as having site control, zoning approvals, permits, and good title etc.;

- if the Borrower is a for-profit organization, satisfaction of the For-Profit Reasonable Expectations Test;

- if the Borrower is a nonprofit organization, satisfaction of the Nonprofit Reasonable Expectations Test; and

- substantial community impacts will be timely achieved.

However, it is important to note that once a short-fall in financing is determined (a that a short-fall could occur), it is critical to get on the “radar screens” of Allocatees in order to be high-lighted in their annual Allocation Awards applications to the CDFI Fund or become part of their pipeline of proposed NMTC Financings.

Therefore, careful planning is needed to proceed with all sources of the capital stack concurrently with applying for NMTC Financing.

B. Substantial Community Impacts

A Borrower must qualitatively and quantitatively provide support of substantial direct and indirect community and economic impacts to the residents of the “Low-Income Community” in which the Borrower and/or project is predominantly located, surrounding communities and “Targeted Populations,” including “Low-Income Persons.”

Such community and economic impacts include any of the following:

- direct and indirect full-time and part-time job creation, job retention and/or construction jobs;

- jobs that provide living wages, healthcare benefits, retirement plans, life insurance, job training, and/or continuing education;

- consumer goods and services;

- community goods and services;

- below-market lease rates and favorable terms to non-profit, minority-owned or women-owned tenants;

- affordable housing (if part of a qualified mixed-use project);

- “green” type benefits (such as LEED certified or at least qualified to be LEED certified);

- minority impacts; and/or

- any other community benefits (such as renovating a historic structure or reducing blight).

C. Strong Local Support

A Borrower must be able to show that the NMTC Financing has and will receive strong local support. For example, this can be shown by:

-

- the project, equipment, or business or nonprofit operations, as applicable, being part of an economic development plan;

-

- letters of support from local officials, community leaders, and/or local businesses and nonprofits;

-

- receipt of governmental subsidies and private sources of capital; and/other project, equipment, or business or nonprofit operations, as applicable, being part of an economic development plan;

-

- letters of support from local officials, community leaders, and/or local businesses and nonprofits;

-

- receipt of governmental subsidies and private sources of capital; and/or

-

- expected subsequent catalytic investment in the “Low-Income Community” and surrounding areas as a direct or indirect result of the NMTC Financing.

We provide an objective third party confirmation of local support (including interviews with local governmental officials and community stakeholders) and provide a persuasive and detailed narrative that the NMTC Financing will facilitate a true public/private partnership (including any indirect investment in the community based on our impact analysis).

D. But-For Test

Congress authorized the NMTC Program in order to reduce the cost of capital in Low-Income Communities outside of the traditional financial marketplace. In order to address this intent, the NMTC industry uses the so-called “But For Test,” which can be satisfied by various scenarios, such as, but for the NMTC Financing:

- the Project will not move forward or will be significantly delayed or reduced in scope;

- the community impacts will not be realized or will be significantly delayed or reduced in scope;

- the Project would otherwise be located or related in a community that is not in a Low-Income Community;

- the Project is at risk for not being financially sustainable (such as the terms of traditional financing being overly burdensome); or

- a combination of any of the aforementioned scenarios.

6. Competitive Advantages

The CDFI Fund has encouraged Allocatees to deploy certain percentage of their Allocations for certain purposes.

Sub-CDEs who commit to do so score better on their Allocation Applications and, if they so deploy, then score better on their subsequent Allocation Applications. Therefore, potential borrowers whose Projects have any of these factors are more competitive in securing NMTC Financing.

We maintain an updated profile of each Allocatee for these factors.

A. Highly Distressed Low-Income Communities

The CDFI Fund encourages Allocatees to deploy a percentage of their Allocations to “highly distressed” Low-Income Communities. To be “highly distressed,” the Low-Income Community must have (a) at least one of four “primary” distress criteria or (b) at least two “secondary” criteria.

To date, 76% of Allocations have been deployed in “highly distressed” Low-Income Communities.

There are 4 “primary” distress criteria which are used to determine whether a census tract is “highly distressed:” (a) “Non-Metropolitan Census Tract;” (b) a poverty rate greater than 30%; (c) a median family income rate not exceeding 50%; and (d) an unemployment rate of at least 1.50X the national rate.

There are 4 “primary” distress criteria which are used to determine whether a census tract is “highly distressed:” (a) “Non-Metropolitan Census Tract;” (b) a poverty rate greater than 30%; (c) a median family income rate not exceeding 50%; and (d) an unemployment rate of at least 1.50X the national rate.

“Secondary” distress criteria include but are not limited to: (a) a poverty rate greater than 25%; (b) a median family income rate not exceeding 60%; (c) an unemployment rate of at least 1.25X the national rate;

(d) being in a medically underserved area (if the borrower is a health care provider); (e) being in a food desert (if the borrower provides healthy foods); (f) being in an SBA HUBZone (if the borrower is an SBA business); and (f) being located in a federal, state or local area which has been designed as economically distressed (such as a Brownfield Site or Enterprise Zone etc.). The CDFI Fund uses the 2016-2020 American Community Survey issued by the U.S. Census Bureau.

B. Non-Metropolitan

Additionally, CDFI Fund encourages Allocatees to deploy a percentage of their Allocations to “Non-Metropolitan” Low-Income Communities.

Whether a Low-Income Community is “Non-Metropolitan” is based on the 2016-2020 ACS.

C. Innovative Investments

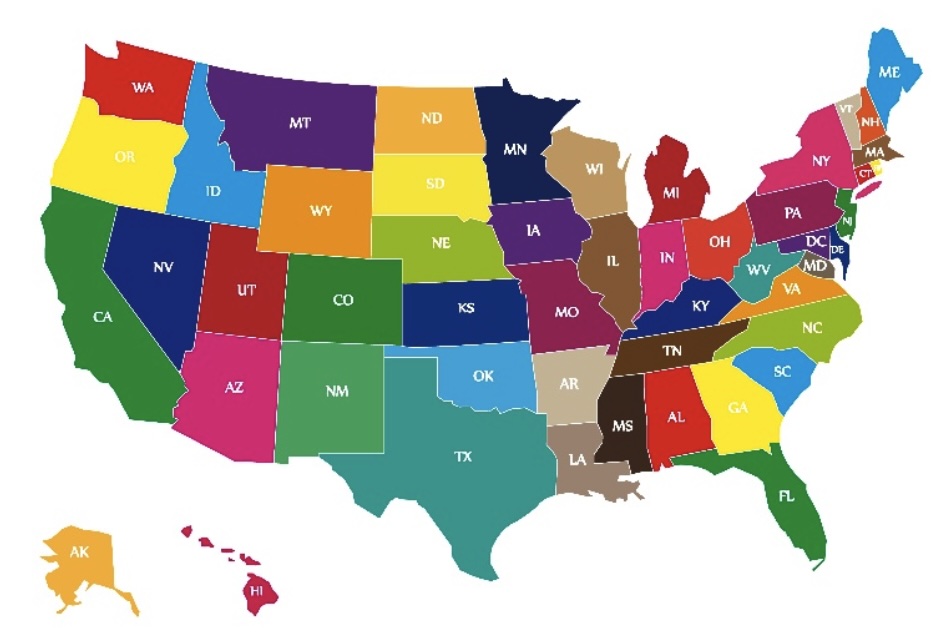

Furthermore, the CDFI Fund encourages Allocatees to deploy a percentage of their Allocations for so-called “Innovative Investments,” which include, in relevant part, (a) “Non-Real Estate Activities;” (b) states identified by the CDFI Fund as having received fewer dollars of NMTC Financing historically (“Identified States”); and (c) QLICI Loans that are either (i) $4 million or less or (ii) have a term of 60 months or less (each an “Innovative QLIC Loan”).

“Non-Real Estate Activities” are defined as working capital, inventory or equipment purchase.

Currently, the Identified States include:

-

- Arizona

- California

- Colorado

- Florida

- Nevada

- North Carolina

- Tennessee

- Texas

- Virginia

- West Virginia

- U.S. territories

The vast majority of NMTC Financings involve the Forgivable QLICI Loan. However, several Allocatees provide the NMTC Financing in the form of QLICI Loans that are $4 million or less or have a term than are 60 months or less. These QLICI Loans are not forgivable; however, they provide at least 5 Favorable Terms.

These financings are not complicated and, therefore, the closing costs are not substantial.

7. Recapture Events

The NMTCs are recognized by the NMTC investor over the 7-Year Compliance Period as follows: 5% in each of the first 3 years, and 6% in the remaining 4 years.

Unlike other federal tax credit programs, if there is a “Recapture Event” during the 7-Year Compliance Period, then 100% of the NMTCs are:

-

- “recaptured” for all prior years (which means that the Tax Credit Purchaser must pay income taxes equal to such recaptured NMTCs as well as interest and penalties), and

- “disallowed” for all remaining years.

During the 7-Year Compliance Period, with respect to a Borrower, a “Recapture Event” includes:

-

-

- the CDE ceases to be a “CDE;”

- the QLICI Loans are prepaid;

- the QEI is redeemed or otherwise cashed out by the CDE; and

-

if a principal purpose of a transaction or a series of transactions is to achieve a result that is inconsistent with the purposes of Section 45D and related Treasury Regulations if the IRS chooses to treat the transaction or series of transactions as causing a Recapture Event (the “Anti-Abuse Recapture Event”).

The Tax Credit Purchaser requires that the borrower and/or its affiliates guarantee the tax and economic consequences that occur as the result of any Recapture Event that it caused by the borrower as well as transactions subject to the Anti-Abuse Recapture Event.

It is important to note that NMTC Financings are carefully underwritten, the transaction documents are very specific as to the obligations of the borrower, many legal and accounting professionals have reviewed the transaction documents and structuring, there is ongoing compliance and monitoring to identify any potential risk of a Recapture Event, and there are remedial actions that can often be taken.

8. Financial, Tax and Compliance Reporting

Each of the Senior QLICI Loan and the Forgivable QLICI Loan must be treated as “debt” on the books and records of the borrower and for all financial and tax reporting purposes. However, a note to the financial statements provides a discussion of how the Forgivable QLICI Loan is to be forgiven at the end of the 7-Year Compliance Period, which satisfies Generally Accepted Accounting Procedures.

If any existing and subsequent lender is not familiar with NMTC Financing, transaction participants will provide insight into the mechanics of the NMTC Financing. Often, lenders will need to make an exception for the NMTC Financing to the extent it adversely affects any financial covenants or financial ratio requirements.

Additionally, during the 7-Year Compliance Period, the borrower will need to provide the Tax Credit Purchaser and Allocatee with (a) annual financial statements; (b) tax returns; (c) annual budget; (d) quarterly financial statements; (e) an “Annual Certificate of Compliance;” and (f) an “Annual Community Impact Survey.”

For an example of a typical Annual Certificate of Compliance, please see the following Link: Example of Annual Certificate of Compliance.

For an example of a typical Annual Community Impact Survey, please see the following Link: Example of Annual Community Impact Survey.

As discussed in Section 10, CRA provides various “Post-Closing Management Services.”

Borrowers do not find financial, tax and compliance reporting very difficult to provide.