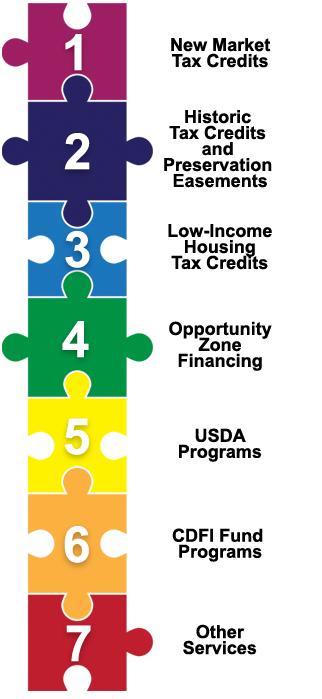

Other Services . . .

State and Local Incentives

State and local governments provide competitive and/or discretionary economic incentives, which include grants; nontraditional financing (such as low interest loans); tax abatements; tax increment financing; and payroll tax credits. These incentives target businesses and nonprofits that make significant capital improvements and/or purchase equipment which provides certain types of community impact. These incentives are often available to those who relocate or expand.

State and local governments provide competitive and/or discretionary economic incentives, which include grants; nontraditional financing (such as low interest loans); tax abatements; tax increment financing; and payroll tax credits. These incentives target businesses and nonprofits that make significant capital improvements and/or purchase equipment which provides certain types of community impact. These incentives are often available to those who relocate or expand.- Community Reinvestment Associates analyzes business and nonprofit operations and evaluates alternative site locations to determine the best available state and local incentives that are available.

- We draft and review applications and assist in obtaining necessary underwriting materials and then negotiate terms of such awarded incentives.

Debt Financing Alternatives

- In addition to (or in lieu of) traditional bank debt, qualified Borrowers and projects may be able to obtain financing provided by tax-exempt and/or taxable bonds; the SBA Loan Programs; the USDA Program; the EB-5 Program; and other programs administered by HUD and FHA.

- Community Reinvestment Associates: (a) analyzes a Borrower’s existing banking relationships and financing documents; (b) evaluates debt coverage and sensitivity levels; (c) assesses current and prospective alternatives (including refinancing) based on local and regional markets; (d) drafts and reviews applications for such alternatives; (e) assists in obtaining necessary underwriting materials; and (f) negotiates the terms of such alternatives.

Cost Segregation

- There are often significant tax benefits derived by utilizing shorter recovery periods and accelerated depreciation methods (including bonus depreciation) for computing depreciation deductions.

- “Cost Segregation“ consists of the reclassifying of assets in order to maximize personal property, optimize depreciation deductions, and therefore provide substantial cash flow benefits (i.e., taking higher deductions sooner rather than later effectively provides an interest free loan from the IRS).

- New construction, renovation, purchased assets, and leasehold improvements provide the opportunity to perform a cost segregation analysis.

- Owners often over allocate costs to real property, which has a 39-year depreciable life (as well as many other types of fixed assets).

- A cost segregation reclassifies some of these costs by allocating fixed assets to shorter depreciable lives (such as 5, 7 or 15-year property compared to 39-year property).

- Community Reinvestment Associates provides qualified cost segregation analyses to support a higher yield due to a so-called “catch-up” on depreciation not previously taken, as permitted by a “Section 481(a) adjustment” permitting under the Internal Revenue Code (i.e., a change in accounting method).