Unwind after 7-Year NMTC Compliance Period: $10 Million NMTC Financing

Forgiven Loan to a Single Borrower

With respect to the Forgiven Loan to a single Borrower, at the end of the 7-Year NMTC Compliance Period, the NMTC Financing unwinds as follows:

With respect to the Forgiven Loan to a single Borrower, at the end of the 7-Year NMTC Compliance Period, the NMTC Financing unwinds as follows:

-

- the NMTC Investor sells its 100% ownership interest in the Investment Fund to an affiliate of the Borrower/QALICB for a nominal amount; and

- the Allocatee directly or indirectly sells its 0.01% managing interest in the CDE to such affiliate of the Borrower/QALICB for a nominal amount.

The effects of the unwind are:

-

- the Forgiven Loan becomes an intercompany loan (i.e., effectively forgiven);

- if Prior Qualifying Expenditures or Borrower equity was used, the Senior Loan also becomes an intercompany loan and is also, effectively forgiven; and

- if third third-party debt was used, the Senior Loan terms are whatever the third-party debt provider requires (such as amortization thereafter).

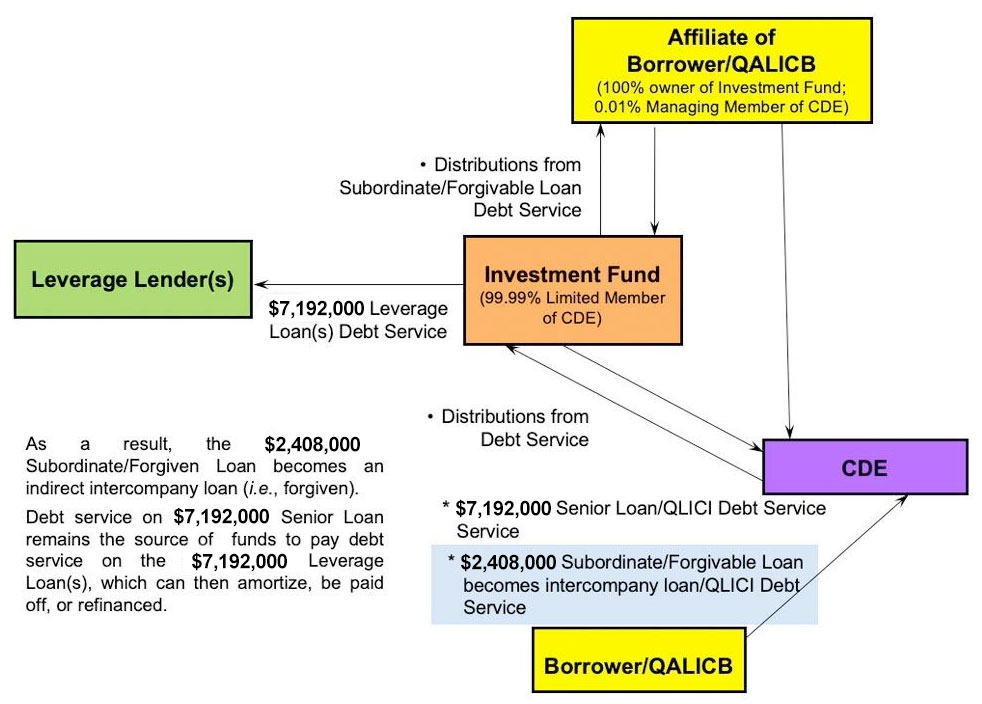

The following flowcharts illustrate the “unwind” transactions and the post-“unwind” structuring of a NMTC Financing involving a Forgiven NMTC Loan to a single Borrower.

Unwind after 7-Year NMTC Compliance Period: Forgiven Loan to a Single Borrower (“Unwind” Transactions)

After the 7-Year NMTC Compliance Period, the Allocatee will redeem its 0.01% managing member interest in the CDE, then the following Unwind Transactions occur:

Unwind after 7-Year NMTC Compliance Period: Forgiven Loan to a Single Borrower (Post “Unwind”)

Loans to a Pool of Borrowers

With respect to the loans to a pool of Borrowers, using our $10 million example, at the end of the 7-Year NMTC Compliance Period, the NMTC Financing unwinds among the NMTC Investor, the Allocate and the Leverage Lender without any involvement from an affiliate of the Borrower (unlike the unwind after the 7-Year NMTC Compliance Period involving the Forgiven Loan to a single Borrower).

For a more detailed discussion of the benefits of NMTC Financing to a Borrower, and applicable legal requirements and underwriting requirements, please click on the following link:

Although the typical NMTC Financing structure quite complex based on all of the sources of funds, the fundamental economics and initial structure of NMTC Financing is illustrated in the following link:

Please click the following link to watch our pre-recorded webinar:

To apply as a Borrower for NMTC Financing, please click on the following link:

For a more detailed discussion of the benefits of participating as a CDE in NMTC Financing, and applicable legal requirements and underwriting requirements, please click on the following link:

To apply as a CDE for a NMTC Allocation Award, please click the following link: