Economics and IRS Approved NMTC Leverage Structure

Tax Credit Purchasers Provide NMTC Subsidy

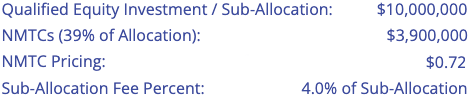

New market tax credits (“NMTCs”) are equal to 39% of the “qualified equity investment” (a “Qualified Equity Investment”) in a community development entity (a “CDE”) for which the Allocatee , makes a “sub-allocation” to the CDE in the same amount from its NMTC Allocation Award.

New market tax credits (“NMTCs”) are equal to 39% of the “qualified equity investment” (a “Qualified Equity Investment”) in a community development entity (a “CDE”) for which the Allocatee , makes a “sub-allocation” to the CDE in the same amount from its NMTC Allocation Award.

None of the Borrower, its affiliates or owners recognize the NMTCs.

A Tax Credit Purchaser is typically a financial institution or a large corporation.

The Tax Credit Purchaser does not receive any direct or indirect ownership interest in the borrower or any of its affiliates.

Instead, the NMTC Investor receives a direct or an indirect ownership interest the CDE.

The CDE then provides the Forgive Loan to the borrower.

The Tax Credit Purchaser “purchases” the NMTCs based on: (a) current market pricing; (b) desirability of participating in the particular NMTC Financing; and (c) whether or not other Tax Credit Purchasers are competing to participate in the particular NMTC Financing.

Therefore, it is critical that borrowers generate as much interest among Tax Credit Purchasers as possible in order to obtain the best pricing for the NMTCs, which directly increases the subsidy dollar for dollar provided by the Forgiven Loan to the Borrower.

We identify, profile and solicit Tax Credit Purchasers (for best pricing and terms) based on current and projected demand for each particular of Borrower and geographic location.

With respect to our related services, please click on the tab entitled “Apply for NMTC Financing,” which is located at the bottom of this page.

Sneak Preview of How Forgiven NMTC Loan Works

It is important to understand that the Forgiven Loan requires another loan (the proceeds of which are indirectly provided by 1 or more Leverage Lenders, which are the providers of the borrower’s other sources of equity, debt, or “Prior Qualifying Expenditures”).

The Forgiven Loan is equal to the difference between: (x) the NMTC Purchase Price, less (y) the Sub-Allocation Fee paid to the Allocatee.

Sub-Allocation = Qualified Equity Investment = to the sum of (x) the NMTC Purchase Price, plus (y) the “Senior Loan.”

The “Senior Loan” is the amount of equity, debt in “Prior Qualifying Expenditures” that the Borrower is able to provide in order to generate a Qualified Equity Investment in a sufficient amount in order for the NMTC Purchase Price (net of the Sub-Allocation Fee) to be sufficient to provide the desired net subsidy of the Forgiven Loan.

As discussed below, the Borrower does not have to provide such equity or debt to the extent that it has “Prior Qualifying Expenditures” (as discussed in under the heading entitled “Special Rule for 2 Years of Prior Qualifying Expenditures”).

NMTC Example:

Assumptions:

Forgiven Loan:

-

- NMTC Purchase Price: $2,808,000

-

-

- This is the equal to the difference of: (x) 39% NMTCs, multiplied by (y) $10,000,000 Qualified Equity Investment), multiplied by (y) $0.72 NMTC Purchase Price.

- Forgiven NMTC Loan: $2,408,000

-

-

-

- This is equal to the difference between: (x) $2,808,000 NMTC Purchase Price, less (y) (4% Sub-Allocation Fee).

-

Senior Load Needed:

Senior Loan: $7,192,000

-

- This is equal to the difference of: (x) $10,000,000 Qualified Equity Investment, less (y) $2,808,000 NMTC Purchase Price.

Sources of Senior Loan:

-

- Credit for “Prior Qualifying Expenditures;“

- Borrower equity;

- Borrower owner loan(s);

- grants; and/or

- third-party debt.

Credit for Prior Qualifying Expenditures:

-

- As discussed below, under the heading entitled “Special Rule for 2 Years of Prior Expenditures,” a borrower is permitted to receive credit for certain prior incurred expenditures. Thus, if the borrower has sufficient “Prior Qualifying Expenditures,” a borrower can obtain the Forgiven Loan without providing any other sources of funds for the NMTC Financing.

Steps to NMTC Financing

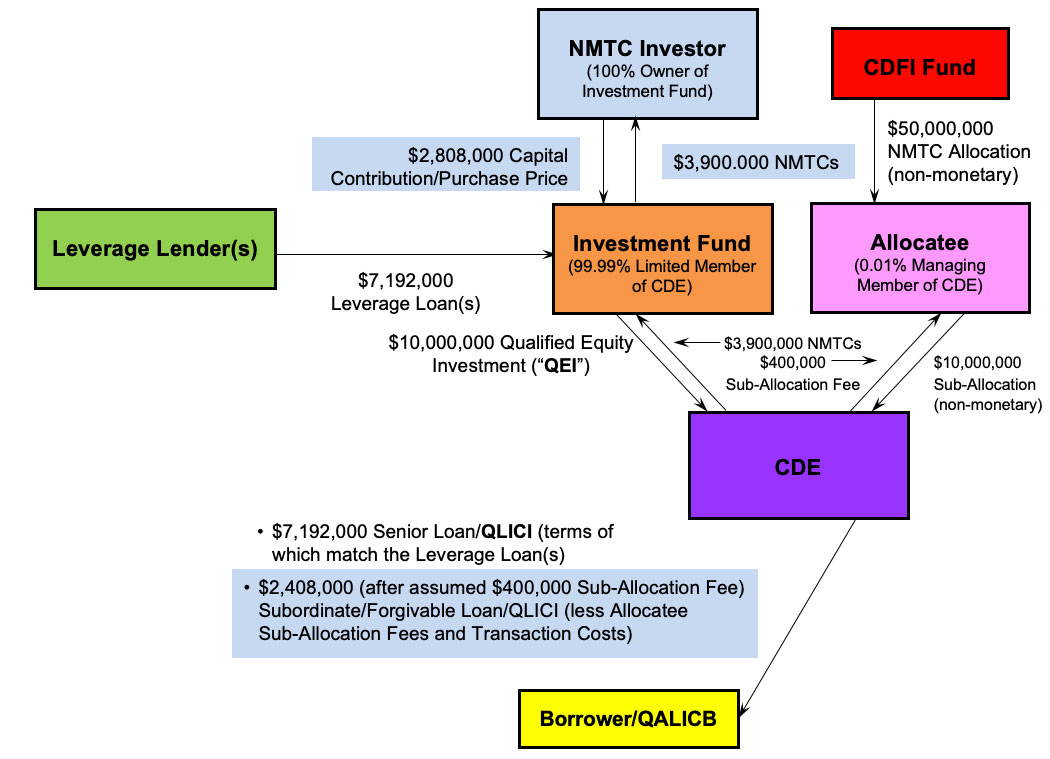

Using our NMTC Example, and illustrated in the flowchart below, assume:

Using our NMTC Example, and illustrated in the flowchart below, assume:

- the borrower satisfies all of the legal requirements to qualify for NMTC Financing;

- the borrower has secured approximately $7,192,000 of other sources of financing and/or a credit for “Prior Qualifying Expenditures;”

- the borrower applies to Tax Credit Purchasers and Allocatees whose service areas and underwriting criteria match the borrower’s and/or project’s facts and circumstances (such as community impacts etc.);

- an Allocatee (which has received a NMTC Allocation Award of $50,000,000 from the CDFI Fund) provides a Sub-Allocation of $10,000,000 of its $50,000,000 Allocation Award.

- the Allocatee spins off a separate CDE for the NMTC Financing;

- the NMTCs are $3,900,000;

- the Tax Credit Purchaser agrees to purchase the $3,900,000 NMTCs for $2,808,000;

- the Tax Credit Purchaser makes a $2,808,000 capital contribution to its wholly owned Investment Fund;

the borrower’s other sources of financing provide one or more Leverage Loan(s), which total $7,192,000, to the Investment Fund (as reduced for any credit for “Prior Qualifying Expenditures”);

the borrower’s other sources of financing provide one or more Leverage Loan(s), which total $7,192,000, to the Investment Fund (as reduced for any credit for “Prior Qualifying Expenditures”);- using the Tax Credit Purchaser’s $2,808,000 capital contribution and the $7,192,000 proceeds of the Leverage Loan(s), the Investment Fund makes a $10,000,000 capital contribution to the CDE;

- the CDE designates the Investment Fund’s $10,000,000 capital contribution in the CDE as a “Qualified Equity Investment;” and

- using the proceeds of the $10,000,000 Qualified Equity Investment, the CDE:

- pays the $400,000 Sub-Allocation Fee to the Allocatee;

- makes a $7,192,000 Senior NMTC Loan to the Borrower (the terms of which match the “Leverage Loan(s)” to the Investment Fund, which must be interest-only during the 7-year NMTC compliance period, and such interest rate may be whatever the borrower’s other sources of financing require); and

- makes a $2,408,000 Forgiven Loan to the Borrower, the terms of which include:

- approximate 1.2% to 1.5% interest-only payments during the 7-year NMTC compliance period, and

- forgiveness at the end of the 7-year NMTC compliance period.

Example of $10 Million NMTC Financing: IRS Approved Leverage Structure

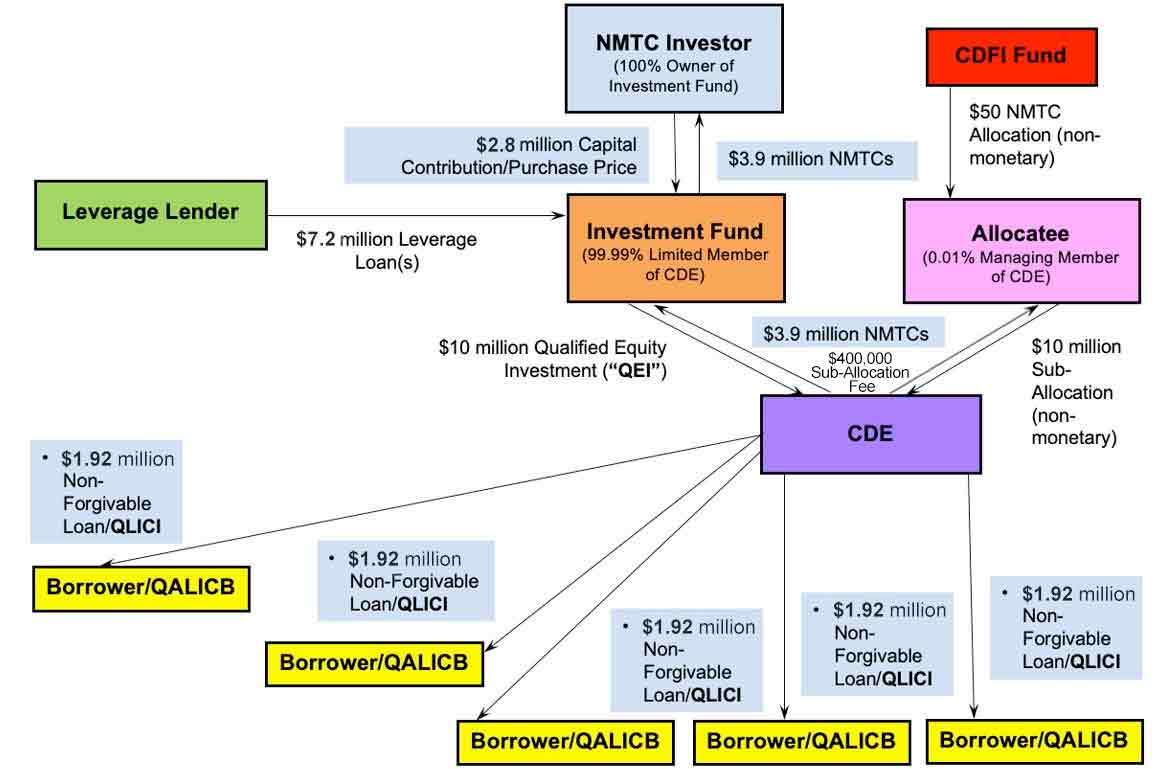

Steps in NMTC Financing: Non-Forgiven NMTC Loans to a Pool of Borrowers

Each of the steps relating to the NMTC Financing in connection with the Forgiven Loan to a single Borrower are generally the same as those for a pool of Borrowers.

Each of the steps relating to the NMTC Financing in connection with the Forgiven Loan to a single Borrower are generally the same as those for a pool of Borrowers.

Generally, in these pool NMTC Financings, the Tax Credit Purchaser, the Allocatee or one of their affiliates is the Leverage Lender.

They are willing to take on such risk because of the diversification of borrowers and smaller rather than taking on the risk of a single borrower in a larger NMTC Financing.

The NMTC Program subsidy is generally in the form of a Non-Forgiven Loan and generally in an amount between $500,000 and $4,000,000.

Example of $10 Million NMTC Financing: Non-Forgiven NMTC Loans to a Pool of Borrowers

Acronyms

- then the CDE uses the QEI proceeds to make 2 “qualified low-income community” (“QLICIs”) in the form of the Senior NMTC Loan and the Forgiven NMTC Loan, to a Borrower, which is:

- a “qualified active low-income community businesses” (each, a “QALICB”), which

- use the QLICIs for the projects or businesses, which are predominantly located in a “low-income community” (a “LIC”) and benefits residents of LICs and/or “Targeted Populations,” including “low-income persons” (“LIPs”).

Leverage Loan Requirements

Generally, with respect to a NMTC Financing involving the Forgiven Loan, identifying and securing sources of funds to be used as Leverage Loan(s) is the most challenging. As discussed below under the heading, entitled “Special Rule for 2 Years of Prior Expenditures,” a borrower receives a credit for “Prior Qualifying Expenditures” as a “deemed” Leverage Loan, which reduces or eliminates having to obtain Leverage Loan(s) from equity or debt providers.

Generally, with respect to a NMTC Financing involving the Forgiven Loan, identifying and securing sources of funds to be used as Leverage Loan(s) is the most challenging. As discussed below under the heading, entitled “Special Rule for 2 Years of Prior Expenditures,” a borrower receives a credit for “Prior Qualifying Expenditures” as a “deemed” Leverage Loan, which reduces or eliminates having to obtain Leverage Loan(s) from equity or debt providers.

A Leverage Lender (if provided by a third-party debt provider) is quite difficult to secure because the Leverage Lender:

- cannot receive a mortgage or direct lien on the project or any of the Borrower’s assets;

- must accept as its sole collateral the Investment Fund’s 99.99% ownership interest in the CDE (the “99.99% CDE Interest”);

- cannot require the Borrower (or its owners) to guaranty the Leverage Loan;

- can only require interest-only payments during the 7-Year NMTC Compliance Period; and

- must agree to a 7-year forbearance from foreclosing on and obtaining the 99.99% CDE Interest.

Therefore, if the Borrower has sufficient “Prior Qualifying Expenditures,” it can avoid needing a third-party Leverage Lender.

“Prior Qualifying Expenditures:”

- are those including (a) the acquisition of land; (b) the purchase, renovation, or expansion of a facility; (c) the purchase or refurbishment of equipment; (d) the purchase of raw materials or inventory; (e) the costs of direct labor (as part of costs of goods sold or as part of a service provider’s services); and (f) the costs of research and development;

- must be directly attributable to the borrower’s operations;

- must be similar in scope and amount when compared to similar borrower’s operations;

- must not be paid to a related party (except to the extent such related party paid an unrelated party); and

- which were incurred within 2 years of the date of the funding of the Forgive Loan.

Generally, for every $1.00 of Prior Qualifying Expenditures, the borrower will receive approximately $0.18 (i.e., 18%) net Forgiven NMTC Loan proceeds (after all legal, accounting and placement fees as well as closing costs).

We:

- work with the borrower’s potential sources of Leverage Loans to assist them in understanding the NMTC program and assessment of actual risk rather than perceived risk;

- identify and secure sources of these leverage funds particularly focusing on those with experience in NMTC Financings; and

- determine whether the overall financing can be restructured based on all sources of financing in order to reduce risk or otherwise re-channel where the sources of financing are coming into the overall financing structure.

2-Year Prior Expenditure Rule: Deemed Leverage Loan

For example, if the borrower has $10,000,000 of Prior Qualifying Expenditures, the borrower will be able to receive approximately $1,800,000 of net Forgiven Loan proceeds (after all legal, accounting and placement fees as well as closing costs).

EXAMPLE #1:

Assume that the Borrower has as gap in financing in the amount of $2,408,000 million and has at least $7,192,000 of Prior Qualifying Expenditures or other sources of capital.

The Borrower is able to qualify for a Sub-Allocation of $10,000,000 (taking into account the $400,000 Sub-Allocation Fee, which is paid out of the proceeds of the NMTC Purchase Price provided by the Tax Credit Purchaser).

The NMTC Purchase Price would be $2,808,000 (which is product of: (x) $0.72 NMTC Purchase Price, times (y) 39% NMTC, times (2) $10,000,000 Sub-Allocation.

NMTCs, times (z) $10,000,000 Sub-Allocation

The NMTC Financing would include:

- Forgiven Loan: $2,408,000 (which is difference between: (x) $2,808,000 NMTC Purchase Price less (y) $400,000 Sub-Allocation Fee (which is 4.0% of the $10,000,000 Sub-Allocation).

- Senior Loan: $7,192,000 (which is the amount of Prior Qualifying Expenditures and other capital and the debt service payments of which relate to the Prior Qualifying Expenditures are paid back to the Borrower).

Therefore, for every $1.00 shortfall that the Borrower is able to provide (whether Prior Qualifying Expenditures and other sources of capital), it will be able to obtain a $0.335 Forgiven Loan (which is difference between: (x) $2,408,000 divided by (y) $7,192,000).

This example does not include legal, accounting, placement and other typical fees of a NMTC Financing.

EXAMPLE #2:

Assume that the Borrower has as gap in financing in the amount of $2,880,000 but only has $7,192,000 of Prior Qualifying Expenditures or other sources of capital (similar to Example 1).

Although the Borrower is able qualify for a NMTC Allocation of $10,000,000 (taking into account the $400,000 Sub-Allocation Fee, which is paid out of the proceeds of the NMTC Purchase Price provided by the Tax Credit Purchaser), the Borrower would still have a short fall of $480,000 (which is the difference between: (x) $2,880,000 shortfall, less (y) $2,408,000 (which can be funded with its $7,192,000 of Prior Qualifying Expenditures and other sources of capital, as in Example 1).

If the Borrower is able to secure an additional $359,600 of other financing (whether owner equity, debt or grants), it will then be able to secure a $10,500,000 Sub-Allocation.

The NMTC Purchase Price would be $2,948,400 (which is the product of (x) the $0.72 NMTC Purchase Price, times (y) 39% NMTCs, times (z) $10,500,000 Sub-Allocation).

The NMTC Financing would include:

- Forgiven Loan: $2,528,400 (which is the difference between: (x) $2,948,400 NMTC Purchase Price, less (y) $420,000 Sub-Allocation Fee (which is 4.0% of the $10,500,000 Sub-Allocation).

- First Senior Loan: $7,192,000 (which is similar to Example 1).

- Second Senior Loan: $359,600 (which is the difference among: (w) $10,500,000 Sub-Allocation, less (x) $2,528,000 Forgiven Loan, less (y) $1,192,000 First Senior Loan), less (z) $420,000 Sub-Allocation Fee).

Therefore, for every $1.00 shortfall that the Borrower is able to provide (whether Prior Qualifying Expenditures and other sources of capital, it will be able to obtain a $0.335 Forgiven Loan (which is the sum of (x) $2,528,400 Forgive Loan, divided by (y) the sum of: (i) $7,192,000 (similar to Example 1), plus (ii) $359,600 (additional sources of capital).

This example does not include legal, accounting, placement and other typical fees of a NMTC Financing.

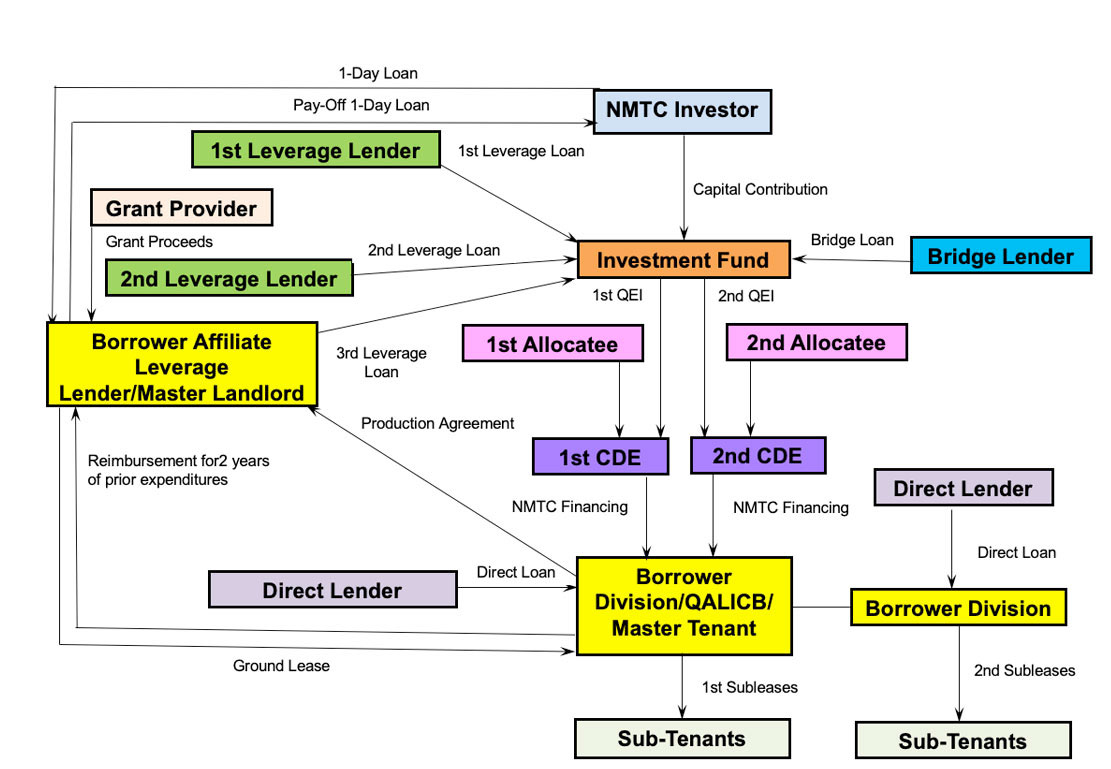

Creativity, Complexity and Opportunity of NMTC Financing

The vast majority of NMTC Financings are facilitated by using the IRS Approved Leverage Structure.

This structure is the basis on which to build the “capital stack” of the overall financing.

Often such financing includes multiple sources of capital or subsidies, which can create complicated structures.

Although complicated, such structuring maximizes the economic benefit to the borrower based on all applicable underwriting, legal and tax requirements for each source of financing.

We size and update each particular financing using our proprietary NMTC “capital stack” program to ensure the most efficient use of all sources of financing, which provides the maximum bottom line economic benefit to our clients.

Our extensive experience in structuring these complex transactions permit us to be able to be quite creative in structuring each overall financing while still satisfying all legal, tax and underwriting requirements of all sources of financing.

The following flowchart illustrates multiple Allocatees, CDEs, Leverage Lenders, and other sources of financing, as well as organizational restructuring.

Creative NMTC Financing Example

With respect to NMTC Financing applications filed on behalf of our clients, we serve as a gateway of credibility because we sign off on all of the legal, underwriting, tax and structuring requirements as being completely satisfied based on our 25 years of finance, legal, accounting, tax, and community and economic development experience, as well as our relationships with Tax Credit Purchasers, Allocatees, and Leverage Lenders.

For a discussion and illustration of the unwind of NMTC Financing after the 7-year NMTC compliance period, please click on the following link:

For a more detailed discussion of the benefits of NMTC Financing to a borrower, and applicable legal requirements and underwriting requirements, please click on the following link:

Please click the following link to watch our pre-recorded webinar:

To apply as a borrower for NMTC Financing, please click on the following link:

For a more detailed discussion of the benefits of participating as a CDE in NMTC financing, and applicable legal requirements and underwriting requirements, please click on the following link:

To apply as a CDE for a NMTC Allocation Award, please click the following link: