We are interested in participating as a Borrower in New Markets Tax Credit Financing . . .

Generally, with respect to the Forgiven Loan:

-

- it only requires approximate 1.2% to 1.5% interest-only payments during the 7-year NMTC compliance period; and

- it is forgiven at the end of the 7-year NMTC compliance period.

Generally, the economic benefits of the Forgiven Loan) include:

- approximate 1.2% to 1.5% interest-only payments during the 7-year NMTC compliance period and forgiveness after such period;

- below-market interest-only payments during the 7-year NMTC compliance period (which rate may continue through the maturity date which can be up to 40 years and beyond any secured asset’s useful life);

- subordination to existing and subsequent debt;

- various non-traditional and favorable terms;

- subject to flexible financial underwriting criteria (permitting higher than standard loan to values (or not even requiring an appraisal); permitting lower than standard debt service coverage ratios; accepting lower credit scores; accepting limited business history; accepting non-traditional forms of collateral (such as inventory and limited equity requirements, if any);

- no personal guarantees with respect to the Forgiven Loan (if certain reserves are established);

- ability to “leverage” other sources of financing for a multiplier economic benefit using the IRS Approved Leverage Structure;

- “softer” foreclosure and enforcement rights (because the NMTC Investor does not require a return of its purchase price for the NMTCs and the Allocatee is not using its own funds in the NMTC Financing);

- if applicable, state NMTCs provide additional subsidy;

- ability to obtain additional financing (based on the favorable and nontraditional terms discussed above); and

- substantial community and economic impacts to residents in “Low-Income Communities” and “Targeted Populations.”

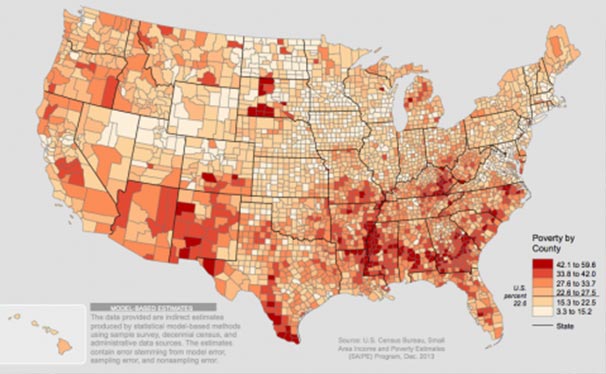

We identify, profile and solicit Allocatees and Tax Credit Purchasers that provide optimal nontraditional and favorable terms and flexible underwriting requirements based on current and projected demand for certain types of Borrowers (whether for-profit or nonprofit), uses of NMTC Financing (such as real estate, equipment or operations), types of communities that will benefit from the NMTC Financing (such as urban or rural or characterized by certain distress criteria (such as higher unemployment rates or poverty rates), and location in the country (based on Tax Credit Purchasers’ and Allocatees’ service areas or targeted so-called “underserved states”).

“predominantly” located in a “Low-Income Census Tract” or otherwise benefit “Targeted Populations;”

“predominantly” located in a “Low-Income Census Tract” or otherwise benefit “Targeted Populations;”

at least 50% of its total gross income must be derived from the active conduct of a “Qualified Business” within one or more “low-income communities” (the “Gross Income Test”);

at least 50% of its total gross income must be derived from the active conduct of a “Qualified Business” within one or more “low-income communities” (the “Gross Income Test”);

We have experience in accounting, including previously practicing as certified public accountants and have similar financial certifications. We work with our clients to provide such financial projections in the format and detail required by Investors and Allocatees.

We have experience in accounting, including previously practicing as certified public accountants and have similar financial certifications. We work with our clients to provide such financial projections in the format and detail required by Investors and Allocatees. NMTC Financing may only be used by a

NMTC Financing may only be used by a

A Borrower must qualitatively and quantitatively provide support of substantial direct and indirect community and economic impacts to the residents of the

A Borrower must qualitatively and quantitatively provide support of substantial direct and indirect community and economic impacts to the residents of the