Increase Focus on Manufacturers for NMTC Financing

Release Date: March 1, 2022 to January 4, 2023

Increase Focus on Manufacturers for NMTC Financing

This year, our business plan includes a more targeted and increased effort to secure NMTC Financing on behalf of manufacturers.We are still working with other types of borrowers (including healthcare providers, healthy food providers, educational institutions, renewable energy providers, recycling provides, multifamily developers, and nonprofit which provide community service).

Currently, we are working with “Allocatees” (as described below) who are strongly interested in providing Forgiven Loans to manufacturers, which are located in (a) very economically distressed census tracts; (b) rural census tracts; and/or (c) states which has been designated as “underserved” because they have not received their pro rata share of NMTC Financing (an “Underserved State”) by the Community Development Financial Institutions Fund (which is a division of the U.S. Department of Treasury) (the “CDFI Fund”) for various reasons.

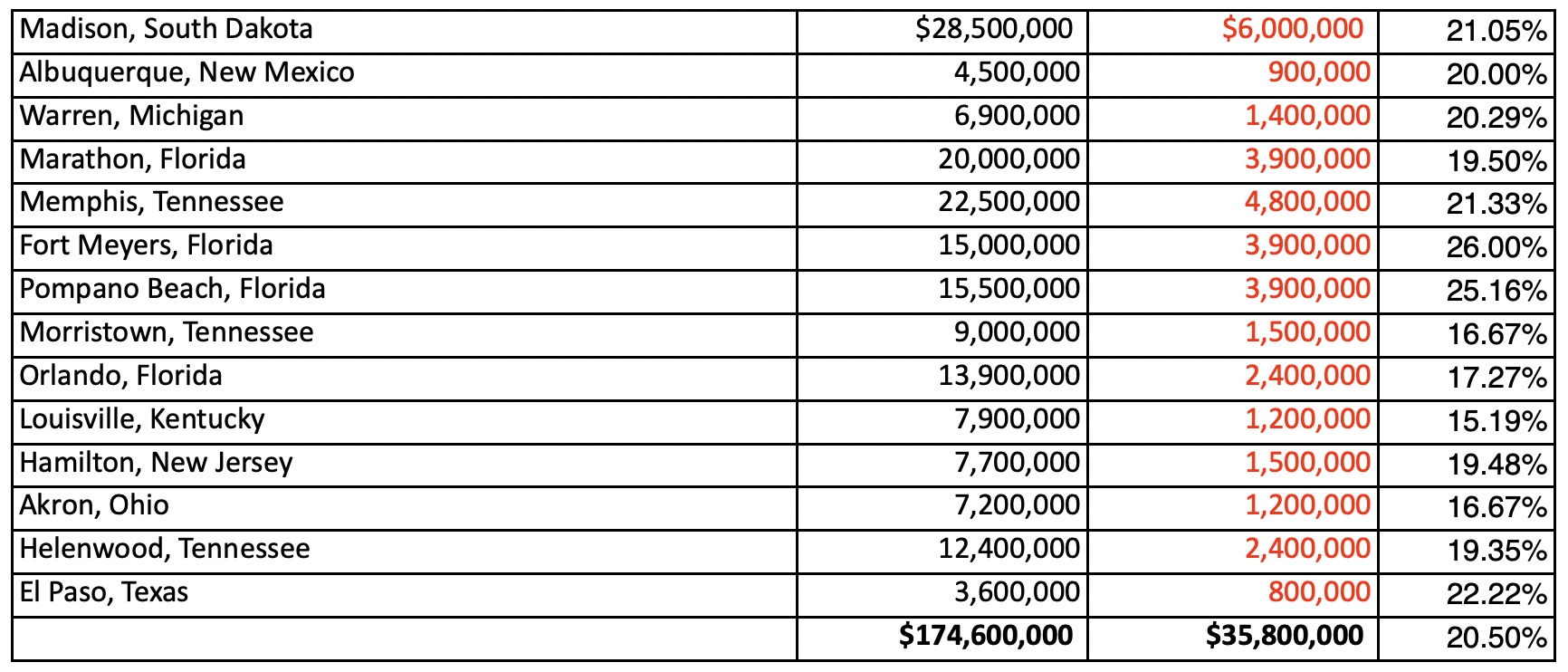

Over the past 6 months, we have secured NMTC Financing that has provided net subsidies (i.e., after all professional and placement fees as well as transaction costs) for each of the following six client manufacturers:

The net subsidy to the Manufacturer is in the form of a Forgiven Loan and is generally between $1.2 million to $2.5 million provided that the Manufacturer (a) has sufficient “Prior Qualifying Expenditures” of at least $6,000,000 (as described herein), and (b) can create new jobs within the next one to three years. No principal is required to be paid and the Forgiven Loan is effectively a grant.

“Prior Qualifying Expenditures” include (a) capital costs (such as the purchase or renovation of the Facility as well as the purchase or refurbishment of equipment); (b) purchase of raw materials or inventory; (c) direct labor costs (as part of costs of goods sold); (d) research and development; or (e) anything that is directly attributable to the Manufacturer’s business and not part of overhead costs.

A. Terms of Forgiven Loan.

NMTC Financing is provided in the form of a 7-Year Forgiven Loan, the terms of which generally include 1.2% to 1.5% interest-only payments for 7 years and then is forgiven. Additional terms include several of the following favorable terms:

- subordination to the Manufacturer’s existing and subsequent creditors;

- limited equity requirements (if any);

- no personal guarantees with respect to the Forgiven Loan (if certain reserves are established);

- nonconventional forms of collateral (or not requiring collateral);

- flexible underwriting criteria (such as high loan to values (up to 400% or higher), lower debt service coverage ratios, and less Manufacturer operational history requirements, etc.); and

- the ability to leverage other sources of financing (including credit for up to 3 years of prior qualifying expenditures) for a multiplier economic benefit.

The Manufacturer does not receive the tax credits but rather a third party purchases the tax credits (the “Tax Credit Purchaser”), as required by the NMTC Program.

The NMTC Program is discussed in great detail on our website.

B. Prior Qualifying Expenditures Generate the Forgiven Loan.

The Forgiven Loan is intended to provide a shortfall in available financing (such as equity and/or debt etc.). The Manufacturer can obtain the Forgiven Loan based solely on its Prior Qualifying Expenditures. If the NMTC Financing closes on or prior to May 31, 2022, up to 3 years of Prior Qualifying Expenditure can be used. Thereafter, it is a 2-year lookback period unless extended by the CDFI Fund. The current 3-year look-back period is permitted due to COVID19 impacts.

For every $1.00 of up to 3 years of “Prior Qualifying Expenditures” (as described in Exhibit A), the Manufacturer generally receives a net 18¢ subsidy. As a practical matter, a Manufacturer needs to have at least $6,000,000 of Prior Qualifying Expenditures for the economics of the NMTC Financing to provide the benefits intended by the NMTC Program. Otherwise, the Manufacturer will need to provide additional equity, debt or other types of financing.

For example, if a Manufacturer has $10,000,000 of Prior Qualifying Expenditures, the Manufacturer will receive approximately $1,800,000 net of transaction participant fees as well as legal, accounting, and placement fees.

Equity and debt can also be used in lieu of, or in addition to, the Prior Qualifying Expenditures. Therefore, for every $1.00 of equity or debt provided by the Manufacturer, an approximate net subsidy of 18% can also be generated.

C. Uses of Forgiven Loan Proceeds.

The Forgive Loan proceeds can be used to:

- acquire, expand and/or renovate real estate;

- purchase and/or refurbish equipment;

- provide up to a year of working capital (including job training, inventory, and employee benefits etc.);

- fund research and development; and/or

- relocate to, or construct a new facility in, another qualifying census tract.

D. Manufacturer Should Have High CRA Score.

We will determine the Manufacturer’s “CRA Score,” which is based on our estimates of potential (a) job impacts; (b) accessibility of jobs to unskilled and/or targeted populations; and (c) other community and economic impacts, as discussed in Section E, Section F, and Section G, respectively.

The Manufacturer’s CRA Score is based, in relevant part, on:

- the Manufacturer’s operations profile;

- the physical location of the Facility based on primary and secondary distress criteria; and

- any other relevant facts and circumstances.

The Manufacturer will also be competitive in obtaining the Forgiven Loan to the extent that the Manufacturer has any of the following designations: (a) Minority Business Enterprise; (b) Minority-Owned Business; (c) Women-Owned Business Enterprise; (d) Women’s Business Enterprise; (e) HUB Zone Certified Business; (f) Disadvantaged Business Enterprise; (g) Historically Underutilized Business; (h) Veteran-Owned Small Business; (i) Disability-Owned Business Enterprise; and (j) other federal, state or local designations.

E. Job Impacts.

The Manufacturer must demonstrate that the Forgiven Loan will result in providing as many (but not necessarily all) of the following direct and indirect job impacts:

- new jobs (including construction jobs) and/or retention of jobs (if at risk);

- jobs that provide “living wages,” bonuses, and healthcare and other benefits;

- job training (particularly if transferable to other employers);

- advanced education (including tuition reimbursements);

- work experience to qualify for certification or professional licenses;

- career advancement; and

- any other employee-oriented benefits (such as paid vacation days and holidays).

F. Accessibility of Jobs to Unskilled and/or Targeted Populations.

A Manufacturer is more competitive if it employs or will employ any of the following: (a) unskilled workers, and (b) other “targeted populations” (such as low-income persons, veterans, minorities, women, the disabled, and those facing barriers to employment (such as those with minimal education and those previously incarcerated, homeless, or suffered long-term unemployment)).

G. Other Community and Economic Impacts.

It is also beneficial if the Forgiven Loan will result in other community or economic impacts to the local community. These impacts can include, for example:

- providing “green” impacts (such using recycled materials; recycling waste; qualifying for LEED certification (or satisfying such standards); environmental remediation; or reducing pollution etc.);

- manufacturing certain types of products (such as those related to healthy foods, healthcare, education, or that benefit the environment);

- purchasing more goods or retaining the services of local businesses; and

- providing any other unique types of community or economic impacts to its employees, the local community or low-income persons.

H. Steps to NMTC Financing.

There are generally 3 parties to an NMTC Financing (a) the Borrower (such as a Manufacturer); (b) an “Allocatee” (as described below); and (c) a Tax Credit Purchaser.

- Each year, hundreds of financial institutions, nonprofits, and other entities apply to the Community Development Financial Institutions Fund (which is a division of the U.S. Treasury Department) for the authority to designate financings as NMTC Financings which generate the tax credits.

- If an applicant receives an authority award, it becomes an “Allocatee.”

- The Borrower (such as a Manufacturer) applies to several (a) Allocatees, and (b) Tax Credit Purchasers.

- Once the Allocatee and NMTC Purchaser are secured, the NMTC Purchaser purchases the tax credits.

- The proceeds of the tax credit purchase price are used to provide the Forgiven Loan to the Borrower.

I. Who are We?

Upon request, we can provide references of NMTC Financings that we have closed.

We are a national boutique tax credit placement firm and have 20 years of experience in NMTC Financings. We:

- have generated and maintained detailed profiles of Allocatees and Tax Credit Purchasers (our “Internal Profiles,” which we continually update based on our ongoing discussions with Allocatees and Tax Credit Purchasers (to update service areas, targeted types of Manufacturers, targeted types of community impacts; underwriting requirements; tax credit purchase price; and fee and reserve requirements);

- based on our Internal Profiles, we identify Allocatees and Tax Credit Purchasers that are the best matches for our client’s particular facts and circumstances;

- work with our clients to draft an executive summary and complete and submit approximately 20 to 25 applications of Allocatees and Tax Credit Purchasers (and provide persuasive and supported responses based on their unique underwriting requirements);

- serve as a gateway of credibility when submitting applications to Allocatees and Tax Credit Purchasers based on our relationships; and

- strategize to obtain as much interest among Allocatees and Tax Credit Purchasers in negotiation optimal and favorable economic and underwriting terms.

100% of our fees are contingent upon the funding of the Forgiven Loan.

We have developed and continue to update our Comprehensive NMTC Intake Form for Manufacturers and other types of borrowers.

Upon engagement, we will (a) provide our client with our Comprehensive NMTC Intake Form; (b) answer our client’s questions in connection with completing questions relating to their proposed NMTC Financing; (c) structure the overall financing to satisfy all legal, tax, and structuring requirements (subject to NMTC attorney and accountant review); (d) confirm that all of the Allocatees’ and Tax Credit Purchasers’ unique underwriting requirements will be satisfied; (e) provide a detailed primary and secondary distress analysis of the census tract; (f) provide support for the quantification and qualification of direct and indirect community and economic impacts; (g) assess and secure strong local support; (h) assess possible catalytic subsequent economic and community development; and (i) provide supplemental services depending on the particular facts and circumstances of the proposed NMTC Financing.

Please feel free to call or email Scott Sunagel at 312.881.0966 or scott@crassociates-llc.com if you have any questions regarding the benefits of, and your organization’s qualification for, NMTC Financing.