Economics and IRS Approved NMTC Leverage Structure

Investor Provides NMTC Subsidy

New market tax credits (“NMTCs”) are equal to 39% of the “qualified equity investment” (a “Qualified Equity Investment”) in a community development entity (a “CDE”) for which the Allocatee , makes a “sub-allocation” to the CDE in the same amount from its NMTC Allocation Award.

New market tax credits (“NMTCs”) are equal to 39% of the “qualified equity investment” (a “Qualified Equity Investment”) in a community development entity (a “CDE”) for which the Allocatee , makes a “sub-allocation” to the CDE in the same amount from its NMTC Allocation Award.

None of the Borrower, its affiliates or owners recognize the NMTCs.

A NMTC Investor is typically a financial institution or a large corporation.

A NMTC Investor does not receive any direct or indirect ownership interest in the borrower or any of its affiliates.

Instead, a NMTC Investor receives a direct or an indirect ownership interest the CDE.

The CDE then provides the Forgive Loan to the borrower.

A Tax Credit Purchaser “purchases” the NMTCs based on: (a) current market pricing; (b) desirability of participating in the particular NMTC Financing; and (c) whether or not other Tax Credit Purchasers are competing to participate in the particular NMTC Financing.

Therefore, it is critical that borrowers generate as much interest among Tax Credit Purchasers as possible in order to obtain the best pricing for the NMTCs, which directly increases the subsidy dollar for dollar provided by the Forgiven Loan to the Borrower.

We identify, profile and solicit NMTC Investors (for best pricing and terms) based on current and projected demand.

With respect to our related services, please click on the tab entitled “Apply for NMTC Financing,” which is located at the bottom of this page.

Sneak Preview of How Forgiven NMTC Loan Works

It is important to understand that the Forgiven Loan requires another loan (the proceeds of which are indirectly provided by 1 or more Leverage Lenders, which are the providers of the borrower’s other sources of equity, debt, or “Prior Qualifying Expenditures”).

The Forgiven Loan is equal to the difference between: (x) the NMTC Purchase Price less (y) the Sub-Allocation Fee paid to the Allocatee.

Sub-Allocation = Qualified Equity Investment = to the sum of (x) the NMTC Purchase Price, plus (y) the “Senior Loan.”

The “Senior Loan” is the amount of equity, debt in “Prior Qualifying Expenditures” that the Borrower is able to provide in order to generate a Qualified Equity Investment in a sufficient amount in order for the NMTC Purchase Price (net of the Sub-Allocation Fee) to be sufficient to provide the desired net subsidy of the Forgiven Loan.

As discussed below, the Borrower does not have to provide such equity or debt to the extent that it has “Prior Qualifying Expenditures” (as discussed in under the heading entitled “Special Rule for 2 Years of Prior Qualifying Expenditures”).

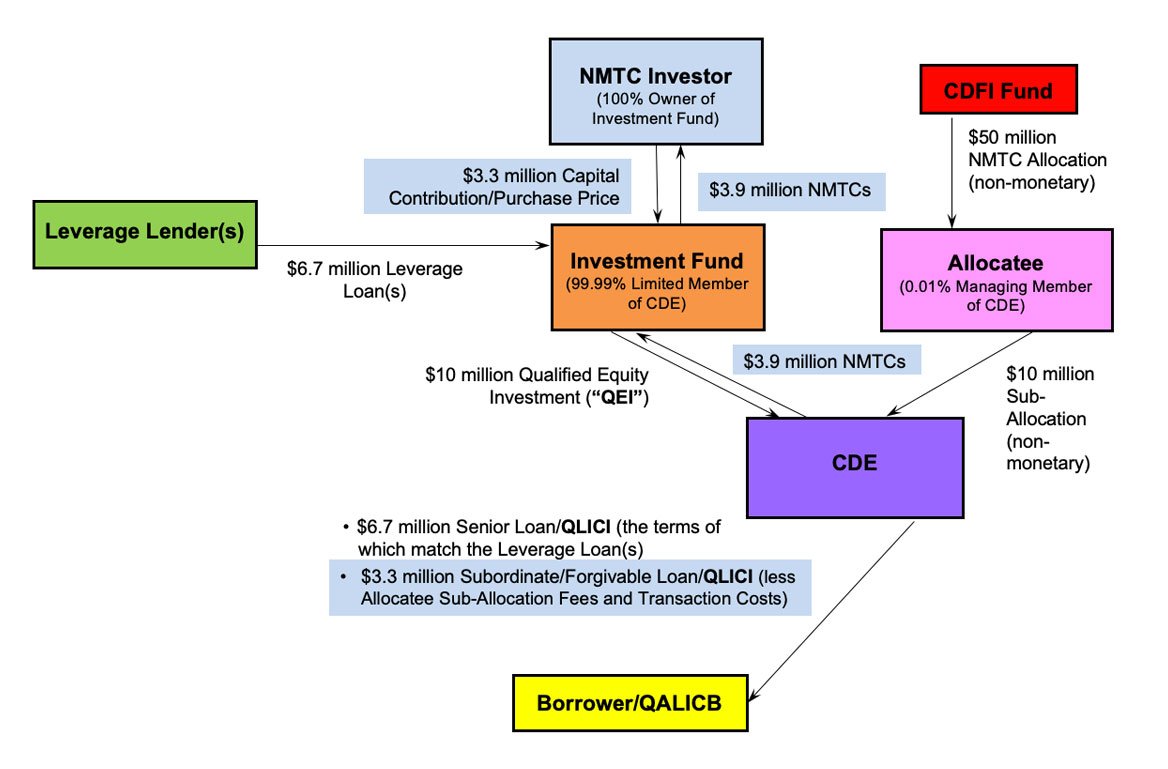

Steps to NMTC Financing: Forgiven NMTC Loan to a Single Borrower

As illustrated in the flowchart below, assume:

As illustrated in the flowchart below, assume:

- the Borrower satisfies all of the legal requirements to qualify for NMTC financing;

- the Borrower needs $10 million of NMTC financing (and has secured approximately $6.7 million of other sources of financing);

- the Borrower applies to NMTC Investors and Allocatees whose service areas and underwriting criteria match the Borrower’s and/or project’s facts and circumstances (such as community impacts etc.);

- an Allocatee (which has received a non-monetary NMTC Allocation award of $50 million from the CDFI Fund) provides a commitment letter to “sub-allocate” $10 million of its non-monetary $50 million NMTC Allocation Award for the $10 million NMTC financing;

- the Allocatee spins off a separate CDE for the $10 million NMTC financing (and its remaining non-monetary $40 million NMTC Allocation Award will be used for other NMTC financings);

- a NMTC Investor agrees to participate in the $10 million NMTC financing and agrees to purchase the 39% NMTCs for $0.84 per $1.00 NMTC, which would be $3.3 million (i.e., $10 million NMTC financing x 39% NMTCs x $0.84 assumed market pricing);

- the NMTC Investor makes a $3.3 million capital contribution (which is the effective “purchase price” for the NMTCs) to its wholly-owned Investment Fund;

the Borrower’s other sources of financing provide one or more Leverage Loan(s), which total $6.7 million, to the Investment Fund (as reduced for certain expenditures made by the Borrower during the prior 2 years (as discussed below));

the Borrower’s other sources of financing provide one or more Leverage Loan(s), which total $6.7 million, to the Investment Fund (as reduced for certain expenditures made by the Borrower during the prior 2 years (as discussed below));- using the NMTC Investor’s $3.3 million capital contribution and the $6.7 million proceeds of the Leverage Loan(s), the Investment Fund makes a $10 million capital contribution to the CDE

- the Allocatee “sub-allocates” $10 million of its $50 million non-monetary NMTC Allocation Award to the CDE;

- the CDE designates the Investment Fund’s $10 million capital contribution in the CDE as a “qualified equity investment” (a “QEI,” on which the 39% NMTCs are based, which are allocated 100% to the NMTC Investor through its wholly-owned Investment Fund); and

- using the proceeds of the $10 million QEI, the CDE provides the following NMTC financing to the Borrower:

- a $6.7 million Senior NMTC Loan (the terms of which match the “Leverage Loan(s)” to the Investment Fund, (which must be interest-only during the 7-year NMTC compliance period, and such interest rate may be whatever the Borrower’s other sources of financing require)); and

- a $3.3 million Forgiven NMTC Loan, the terms of which include:

- approximate 1.0% to 1.2% interest-only payments during the 7-year NMTC compliance period, and

- forgiveness at the end of the 7-year NMTC compliance period.

Example of $10 Million NMTC Financing: Forgiven NMTC Loan to a Single Borrower

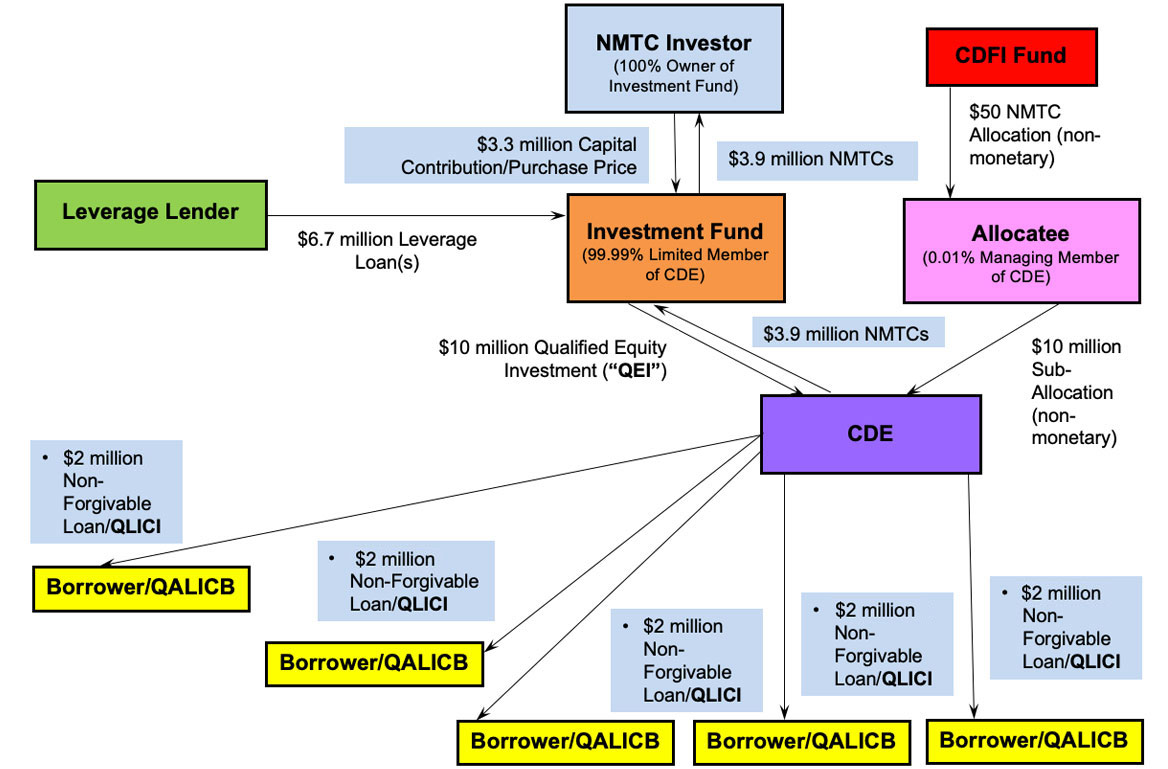

Steps in NMTC Financing: Non-Forgiven NMTC Loans to a Pool of Borrowers

Each of the steps relating to the NMTC financing in connection with the Forgiven NMTC Loan apply to those for the Non-Forgiven Loan, except that the Borrower does not have to provide any source of leverage funds to be run through the Approved IRS Leverage Structure.

This is because given the complexity of financing a pool of Borrowers, adding several sources of leverage becomes too complex.

In these scenarios, generally the NMTC Investor, Allocatee or one of their affiliates is the Leverage Lender.

They are willing to take on such risk because of the diversification of Borrowers with smaller Non-Forgive NMTC Loans rather than taking on the risk of a single Borrower in a larger financing.

The NMTC Program subsidy is then generally in the form of a Non-Forgiven NMTC Loan and generally in the amount between $1 million and $2 million.

Generally, the Non-Forgiven NMTC Loan’s below-market interest rate is the blended interest rate between or among (a) the traditional lender’s Leverage Loan’s market interest rate; (b) the Borrower affiliate’s Leverage Loan’s interest rate; (c) federal, state or local subsidies’ interest rates; and/or (d) the NMTC Investor’s effective “purchase price” which only requires an approximate 1.0% to 1.2% interest rate.

Example of $10 Million NMTC Financing: Non-Forgiven NMTC Loans to a Pool of Borrowers

Acronyms

- then the CDE uses the QEI proceeds to make (a) 2 “qualified low-income community” (“QLICIs”) in the form of the Senior NMTC Loan and the Forgiven NMTC Loan, or (b) QLICIs in the amount of the Non-Forgiven NMTC Loans to a pool of Borrowers, which are

- “qualified active low-income community businesses” (each, a “QALICB”), which

- uses the QLICIs for its project or business, which is predominantly located in a “low-income community” (a “LIC”) and benefits residents of LICs and/or “Targeted Populations,” including “low-income persons” (“LIPs”).

Leverage Loan Requirements

Generally, with respect to a NMTC financing involving the Forgiven NMTC Loan, identifying and securing sources of funds to be used as Leverage Loan(s) is the most challenging.

As discussed below under the heading, entitled “Special Rule for 2 Years of Prior Expenditures,” a Borrower is count certain prior expenditures as a “deemed” Leverage Loan, which reduces or eliminates having to obtain Leverage Loans.

This is because a potential Leverage Lender can be resistant to the requirements of the NMTC Investor, Allocatee and federal tax law.

Specifically, a Leverage Lender:

- cannot receive a mortgage or direct lien on the project or any of the Borrower/QALICB’s assets;

- must accept as its sole collateral the Investment Fund’s 99.99% ownership interest in the CDE (the “99.99% CDE Interest”);

- cannot require the Borrower/QALICB (or its owners) to guaranty the Leverage Loan;

- can only require interest-only payments during the 7-year NMTC compliance period; and

- must agree to a 7-year forbearance from foreclosing on and obtaining the 99.99% CDE Interest.

However, depending on the facts, this challenge can be alleviated by changes in the overall financing structure.

We:

- work with the Borrower’s potential sources of Leverage Loans to assist them in understanding the NMTC program and assessment of actual risk rather than perceived risk;

- identify and secure sources of these leverage funds particularly focusing on those with experience in NMTC financings; and

- determine whether the overall financing can be restructured based on all sources of financing in order to reduce risk or otherwise re-channel where the sources of financing are coming into the overall financing structure.

2-Year Prior Expenditure Rule: Deemed Leverage Loan

A Borrower is permitted to use up to 2 years of prior expenditures as a “deemed” Leverage Loan if such expenditures:

- directly apply to what is being NMTC financed, and

- are or will be “primarily” (i.e., more than 50%) capitalized (i.e., depreciable).

Thus, a Borrower is permitted to use up to 2 years of prior expenditures if they (a) directly apply to what is being NMTC financings, and (b) 51% of more of such expenditures are or will be depreciable.

Example 1:

Assume that a Borrower has incurred $5 million of capitalized expenditures and $2 million of noncapitalized expenditures 2 years prior to the funding of the NMTC financing.

The Borrower may use the entire $7 million of its prior expenditures because $5 million is 71% of the total $7 million of its prior expenditures.

Example 2:

Assume a Borrower has incurred $2 million of capitalized expenditures and $5 million of noncapitalized expenditures 2 years prior to the funding of the NMTC financing.

The Borrower may use $3.9 million of its $7 million of prior expenditures because the $2 million of capitalized expenditures is 51% of the $3.9 million of its prior expenditures (i.e., $2 million divided by 51% equals $3.9 million).

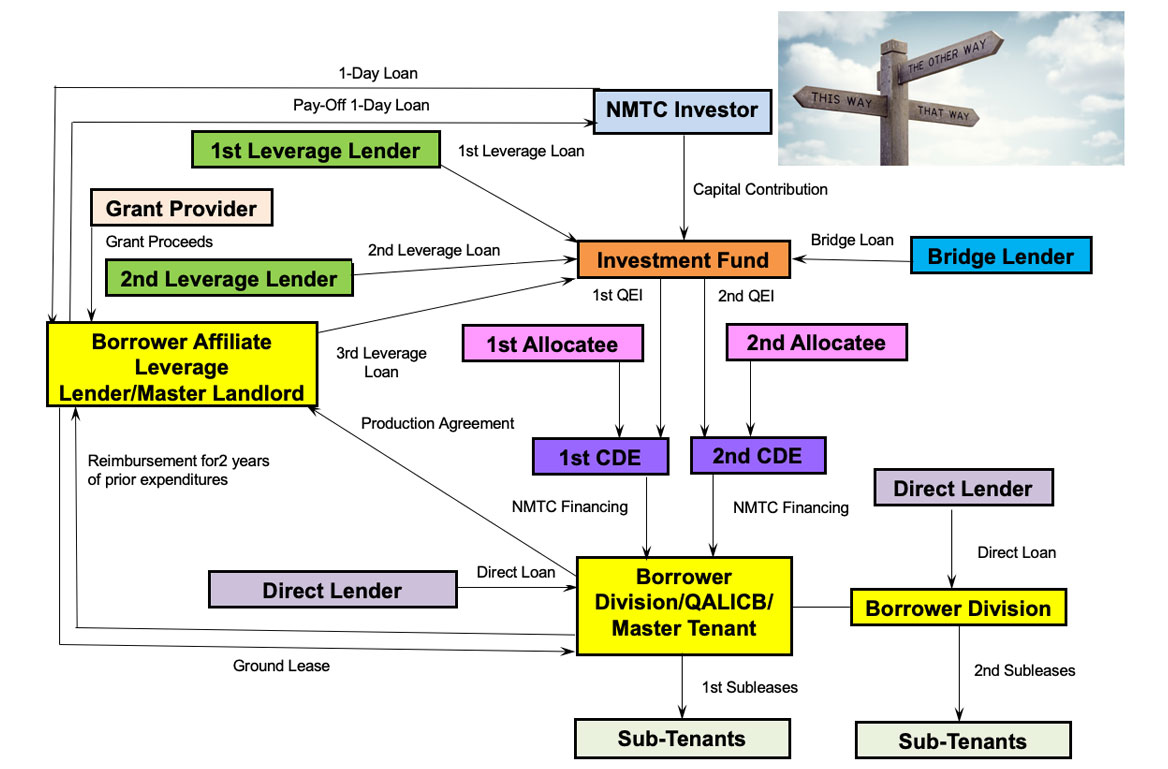

Creativity, Complexity and Opportunity of NMTC Financing

The vast majority of NMTC financings are facilitated using the IRS Approved Leverage Structure.

The vast majority of NMTC financings are facilitated using the IRS Approved Leverage Structure.

This structure is the basis on which to build the “capital stack” of the overall financing.

Often such financing includes multiple sources of financing, which can create complicated structures.

Although complicated, such structuring maximizes the economic benefit to the Borrower based on all applicable underwriting, legal and tax requirements for each source of financing.

We size and update each particular financing using our developed proprietary NMTC “capital stack” software to ensure the most efficient use of all sources of financing, which provides the maximum bottom line economic benefit to our clients.

The following flowchart illustrates multiple Allocatees, CDEs, Leverage Lenders, and other sources of financing, as well as organizational restructuring.

Creative NMTC Financing Example

With respect to NMTC financing applications filed on behalf of our clients, we serve as a gateway of credibility because we sign off on all of the legal, underwriting, tax and structuring requirements as being completely satisfied based on our 25 years of finance, legal, accounting, tax, and community and economic development experience, as well as our relationships with the industry’s NMTC Investors, Allocatees and Leverage Lenders.

For a discussion and illustration of the unwind of NMTC financing after the 7-year NMTC compliance period, please click on the following link:

For a determination of whether the Forgiven NMTC Loan or the Non-Forgiven Loan is available to a Borrower based on the “Forgiven NMTC Loan Test” and the sizing of the NMTC financing, please click on the following link.

Please click the following link to watch our pre-recorded webinar:

To apply as a CDE for NMTC Allocation Award, please click the following link: